Introduction

Vietnam National Shipping Lines (hereafter referred to as Vinalines Corp.) is known as the biggest shipping company in Vietnam. The corporation started to operate in April 1995 on the basis of reorganization of some shipping, port, ship repair, maritime services and logistics companies and organized after the model of a state corporation. At present, the corporation has total 36 member units, 24 out of which are completely state-owned. On September 29, 2006, the corporation restructured and operated after the ÔÇťparent company-subsidiaries/ affiliatesÔÇŁ model with a target of improving business performance. During the period from 2006 - 2010, Vinalines continued to enhance investment and construction of new enterprises in different fields. As a result, at the end of 2010, the equity of Vinalines Corp. increased up to VND 8,118 billion from VND 1,496 billion in 1995 (Vietnam

Transport Development and Strategy Institute, 2013). An number of member companies also rose sharply to 84 units. Fleet of Vinalines Corp. also occupied 40.37% of the total tonnage of Vietnamese fleet (

Vinalines, 2010).

However, under the effect of the economic crisis 2008 - 2009, its business performance started to reduce. Weakness in management and in the forecast of the market, law violations in manufacturing and business, corruption, internal disunity, and especially diversified investment made this worse. For the first time in 15 years of operation, Vinalines Corp. posted a loss of VND 434 billion at the end of 2011. Amid this circumstance, from 2012 the corporation had restructured in terms of organization and ownership structure, governance structure, fleet, financial and seafarer. The restructuring of Vinalines Corp. has been implemented for nearly 4 years and achieved quite many good results such as reduction of debts and losses, equitization of member units, and a focus on the development of core sectors.

The overall purpose of this paper is to conduct a research on alternatives for strengthening the competitiveness of a state-run shipping company, namely Vinalines Corporation, the biggest shipping enterprise in Vietnam in recent years. Accordingly, the first section of the introduction gives a panoramic overview of the current development situation of Vietnam maritime industry and Vinalines. After summarizing literature reviews on the competitiveness of shipping companies, the authors propose some alternatives to help Vinalines Corporation overcome the current difficulties and improve its competitiveness capacity for a sustainable development in the future. In section 3 and 4, via methodologies such as linear optimization, and method of financial analysis. Specifically, the authors argue that privatization is the key solution for every problems faced by the corporation at present. In addition, modification of laws, restructuring of enterprise governance, financial situation, and fleet are also extremely necessary. The last section is devoted to present summary and recommendation. This paper is the first academic research on Vietnamese state-own shipping company.

Literature Review

For the general history of the world shipping industry and in Vietnam particularly, literature on the issue of competitiveness is extensive. However, due to the syntheses and complexities existing in the shipping industry, the previous studies mainly focused one particular area such as port, shipping, or shipbuilding. From the side of port development, a study of

Acosta et al.(2011) discloses 20 determined factors toward the competitiveness of fuel supply at the ports of the Gibraltar Strait including fuel price, geographical advantage, port tariff etc. Meanwhile,

Chou and Chang(2004) were interested in the competitive capacity of the shipbuilding industry. Accordingly, they argued that tangible assets, intangible assets, management capabilities and technology capabilities are four major categories of resources controlled by shipbuilding firms had influence on the competitiveness of this sector. Short sea shipping is also one of the most prominent issues drawing the considerable attention of researchers. In comparison between short sea shipping and road freight transport in mainland port connections,

Sambracos and Maniat(2012) stated that operational cost is the most important factor determined the competitiveness of short sea shipping.

Actually, there are only a handful of research efforts made to investigate systematically and comprehensively the competitiveness of the shipping industry in general. Despite the deficiency in number, they are reviewed here so that the author can utilize them as a reliable source of data for the following study.

Thanopoulou(1998) stated, generally from the perspective of shipping companies, the profitability of the fleet was the direct measure of competitiveness. Because it allowed two essential comparisons at two different aspects : firstly with other industries in an opportunity cost perspective; secondly with competitors at the national and international level.

In the master dissertation of

Truong(2000), he pointed out the effects of ownership factor to the business performance of Vietnamese shipping entities and going public is the method which is highly recommended in his paper.

Lagoudis and Theotokas(2007) examined how four factors namely cost, quality standards, service level and time influence on the competitive advantages of Greek shipping industry, through a survey conducted on a sample of Greek shipping companies. Like existing international literature, the results of this survey validated that quality and time are considered as ÔÇťqualifiersÔÇŁ while cost and service are as ÔÇťwinnerÔÇŁ criteria for the success of shipping companies.

In a study of

Lee(2014) considering a comprehensive evaluation framework for the competitiveness of the shipping industry in a country, he identified total 24 main factors influencing a countryÔÇÖs shipping competitiveness such as port throughput volume, deadweight tonnage capacity of fleet, the amount of native shipping firms and so on as detailed in Table

1.

Table 1

Main Factors influencing Competitiveness of a countryÔÇÖs shipping industry

|

No |

Component |

Factor |

|

1 |

Market share in the export of shipping service |

A country's shipping freight earnings from other countries/the world shipping freight earnings |

|

2 |

Specialization index of shipping service |

A country's shipping freight (earnings-costs)/its shipping freight (earning + costs) in a given year |

|

3 |

Collection-distribution capacity |

The liner shipping connectivity index |

|

4 |

Competence and quality of service delivered by maritime transport |

|

5 |

Factor conditions |

Dead weight tonnage capacity off leet |

|

6 |

National carriagerate |

|

7 |

Average age offleet |

|

8 |

Shipping companies competitiveness |

the number of native shipping firms |

|

9 |

Domestic demand |

Port throughput volume |

|

10 |

Related and supporting industries |

Market share of ship building business |

|

11 |

Market share of ship registration business |

|

12 |

Ratio of owned senior seamen to the world |

|

13 |

Ratio of owned ordinary seamen to the world |

|

14 |

Total shipping lending portfolio provided by major nativebanks |

|

15 |

Gross tonnage share of classification societies |

|

16 |

Market share of ship insurance |

|

17 |

Market share of terminal capacity of major portoperators. |

|

18 |

Quality of port infrastructure |

|

19 |

Time of export and import |

|

20 |

Documents to export and import |

|

21 |

Cost to export and import |

|

22 |

Economic environment |

Gross domestic product |

|

23 |

Trade environment |

Goods export and import |

|

24 |

Commercial environment |

Ease of doing business index |

Policy Adjustment for the Vinalines CorporationÔÇÖs Competitiveness

Restructuring organization and ownership structure of Vinalines Corp. during 2012 - 2015 was under the control and direction of the state by a series of decisions, decrees and circulars. During this tough period, many subsidiary companies of Vinalines Corp. were equitized. Generally, the proportion of capital shares owned by the state reduced from year to year. Particularly, as of November 2015, the number of member units with over 50% of charter capital held by the parent company-Vinalines decreased to 29 units from 37 enterprises in 2010(

Vinalines, 1995-2014). However, the results were not good as expected of the corporation. Specifically, many port companies reported a modest number of stakes purchased by potential investors after their first IPO. This failure was explained because of still-high State shareholder stakes in seaports. Additionally, foreign investors are limited to own no more than 49% of shares in a local company under the Vietnamese law. While a majority of operators in Vietnam ports are foreign businesses, this policy made potential investors reluctant to these enterprises.

Amid this situation, the government had enacted the Dispatch No. 2342/TTg-DMDN. Accordingly, the state only holds an equity ratio of 51% instead of 75% as previously decided in the above ports. However, after all, this figure is still quite high. In this situation, the authors argue that these above reasons are not high persuasive. Firstly, the strong reduction of state shares could help attract more investors, then quickly stepping up the privatization process. Secondly, deep equitization of subsidiaries and the parent company-Vinalines may help the corporation get more hundreds of VND trillion in cash for repayment debts, purchase of more new ships and upgrade of facilities in ports, and so on, thereby improving competitiveness. Finally, the opportunity for Vinalines Corp. to finish itÔÇÖs privatization process is available. Therefore, the corporation should aware to seize opportunities.

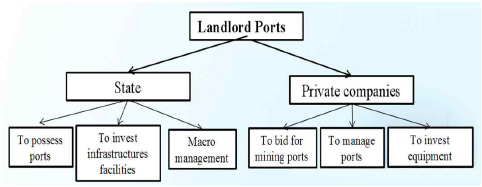

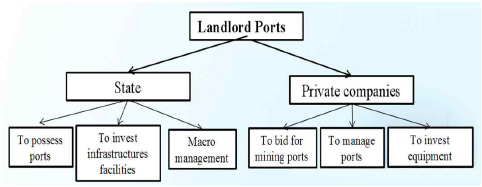

In the case of ports, the authors highly recommend the government to apply the Port Authority model styled ÔÇťLandlord PortsÔÇŁ like in Germany and Netherlands in order to reduce pressure in political issues and increase the performance of port operations(Figure

1). Accordingly, the government reduces its stake down to the rate, at which the whole land and infrastructure facilities in ports will have been invested by the state. The remaining share-holding will be sold to private sectors, which have responsibility for other investments and port operation.

Fig. 1

Port Authority model styled Landlord Ports source : Kamarajar Port Limited website (2014)

Moreover, it cannot and should not assign officials or public servants in the bureaucracy as ÔÇťownerÔÇŁ or ÔÇťrepresentatives of the state capital share in companies.ÔÇŁ Otherwise, it greatly increases the opportunity for corruption, forming the ÔÇťinterest groupÔÇŁ to dominate the market, breaking discipline and law. The manufacturing business results of an enterprise are influenced greatly by national laws, international treaties and agreements which such country has signed or acceded. In the case of maritime sectors, activities of Vietnamese enterprises are prescribed primarily by the Vietnam Maritime Code and Enterprise Law.

The recent maritime code of Vietnam currently is the Vietnam Maritime Code 2005 (hereafter referred as Code 2005). Different from maritime laws of other countries which only adjust a particular sector (shipping law, law seafarers, port law, maritime safety law, ship registration law, marine insurance law, maritime law proceedings and so on), the Code 2005 provisions on matters directly related to maritime activities and stake holders like shipper, shipowner and so on. There are also some shortcomings in the Code 2005.

Firstly, the provisions on carrier liability are still missing and loose with many gaps that could not encourage a sense of responsibility of the carriers for cargo to transport. This makes Vietnamese shipping industry gradually lose customers, even for the domestic market. In this case, in the authorsÔÇÖ opinion, the Code 2005 should probably provision on the liability of the carrier in the whole trip. The change could help increase the responsibility of the carrier for carriage of goods. The carrier shall work hard during the voyage, instead of just before and at beginning the trip to prove his diligence. Besides, the Code 2005 should be added a provision on the liability period of the carrier in providing transport services from door to door, in order to create favorable conditions for the development of multimodal transport. Accordingly, the carrier takes responsibility for the safety of cargo from the receipt of goods at a received place to the delivery of goods at destination port or at the disposal of the recipient at the destination, instead of just from the loading port to discharge port as regulated in the Code 2005.

Secondly, as of May 8, 2013, Vietnam has become the 40th country to sign up to the Maritime Labor Convention 2006 (hereafter MLC 2006). Deployments of the MLC 2006 require Vietnam to supplement and amend national policies on seafarers in compliance with the minimum requirements stated in the MLC. The authors highly recommend adding into the Code 2005 provisions regulating in detail of the rights, obligation and standards for seafarers on board working.

Thirdly, the classification of seaports by size under the Code 2005 makes it difficult for customs authorities at ports to carry out their duty, thus wasting time of customers. It is recommended to add regulations on the classification of seaports under the scope of activities of vessels (domestic or abroad).

Fourthly, there is as need to supplement a particular section of the Code 2005 for the new building, repair and demolition of vessels as the basis for the specific guidelines of the State authorities concerned.

Management Issues for the Vinalines CorporationÔÇÖs Competitiveness

4.1 Governance Structure

The development strategy favored by Vinalines Corp. during 1994 - 2010 was ÔÇťhorizontal diversification.ÔÇŁ Accordingly, the corporation diversified its portfolio in various fields, even in non-core industries such as banking, real estates and securities. However, the economic crisis in 2008 - 2009 seemed to turn advantages of portfolio diversification into disadvantages, which pulled many enterprises of Vinalines Corp. to the verge of bankruptcy or heavy losses. Firstly, the financial situation became difficulty with high debts. Particularly, liabilities were much higher than equity. The business performance was decreasing due to an increase in interest expenses, management expenses and a lot of inefficient investments. Vinalines Corp. faced a gradual decrease in profit since 2009. The corporation lost VND 434 billion in 2011 and the situation is still difficult up to now. Amid this situation, in line with the direction of Vietnamese Government through the decision No.929 QD-TTg (2012), Vinalines Corp. has constructed the plan of restructuring the corporation governance towards ÔÇťgrowth with depthÔÇŁ instead of ÔÇťgrowth with widthÔÇŁ like before. Accordingly, many member units shall equitize, divest, dissolve or go bankruptcy. Vinalines Corp. shall focus on developing three main sectors namely shipping, port and logistics services. The specialization thereby helps increase the quality of services and satisfy customerÔÇÖs requirements.

The authors acknowledge that the approach of growth with depth is really reasonable for the current situation of Vinalines Corp. and suitable with the direction of Vietnam government on restructuring its organization and ownership structure over the last years. In fact, this measure also has been applied by Korea Shipping Corporation in 1966 and NOL in the 1980s. After expanding the market and consolidating trademark, these famous corporations focused on the development of their core services as well as reinforcing expertise of labors(

Thanh-Van LE, 2016). Therefore, Vinalines Corp. should probably more active in implement this plan in order to help the corporation overcome shortcomings relating to management apparatus (like cumbersome structure, like management capacity, high management costs) and low quality of labors, thereby achieving sustainable development in near future.

4.2 Financials

The financial situation of Vinalines Corp. after the economic crisis has been so difficult. Generally, Vinalines Corp. has faced the deficiency of cash to pay its due debts and guarantee working capital. Additionally, high losses in production and business activities also are a worrisome problem with the corporation during this period.

As of December 31 2011, total assets were VND 55,853 billion; equity was VND 9,411 billion; total debts was VND 43,135 billion, in which the amount of debts used to invest in ships, port projects, warehouses and ship repair was VND 34,552 billion; Overdue debt was VND 207 billion. The year 2011 was also the time Vinalines Corp. firstly posted losses with VND 434 billion after 15 years of its operation. Table

2 estimates some financial indicators of Vinalines Corp. in 2011 namely debt-to-equity ratio (D/E), and debt ratio, which are used to measure a companyÔÇÖs financial leverage.

Table 2

Financial Indicators of Vinalines Corp. in 2011

|

Indicators |

Vinalines Corp. |

Average ratio (**)

|

|

Debt-to-Equity ratio |

4.58 |

1.77 |

|

Debt ratio |

0.772 |

0.62 |

The D/E ratio of 4.58 means that the corporation used debt financing equals 458% of the equity. This figure was too high in comparison with the average ratio of total groups and corporations in Vietnam over the same period.

A high debt ratio of 0.772 implies that the corporation would have to sell off 77.2 % of its assets in order to pay off its debts. Once its assets are sold off the business would probably be scaled down or even no longer operate.

Obviously, Vinalines Corp. is a highly leveraged firm, in which a majority of activities depended on loans. This would indicate that the corporation in 2011 was facing a very high financial risk, especially great financial costs. Hereinafter, the authors will analyze in detail solutions in order to find reasons for the above failure, then propose some alternatives for enhancing the current financial situation of Vinalines Corp.

Firstly, ÔÇťcharge-offÔÇŁ is one of the effective measures to help reduce debt pressure on the corporation. However, such approach can only be applied in the short term. As it could affect adversely the performance of the creditors (banks) in case charge off has expired but debtor remains incapable of paying the debt. In this case, solutions for banks include ÔÇťselling the debtÔÇŁ to debt settlement organizations or converting the debt into the charter capital in subsidiaries/ affiliates of Vinalines Corp.

Secondly, ÔÇťselling debts to DATCÔÇŁ is a relatively feasible solution for banks to recover money and Vinalines Corp. to reschedule debt. Thirdly, the conversion of debts into charter equity in the unit members of Vinalines Corp. is a two-sided solution. On one hand, becoming strategic shareholders in member units of the corporation help banks to settle debts and get to entry in the new market. Vinalines Corp. also benefits greatly when an arrow hits several targets. On the other hand, the conversion could play concerned parties at a disadvantage.

On the side of Vinalines: Apart from not a penny obtained from divested member units, most of the companies chosen by banks are ports - the unique group of businesses in Vinalines Corp. can post a profit in recent years. This could make the restructuring process more difficult due to lack of resources.

On the side of banks: In fact, major functions of banks are fundraising and lending in order to allocate capital to various industries of the economy. Accepting conversion of debts into charter capital is frankly a reluctant choice of banks. even there is a consensus between creditor and debtor, the implementation of this plan could delay.

Therefore, the authors argue that this approach is not feasible at least in the immediate period. Even in case the conversion approved by the government, banks and Vinalines Corp. are recommended to review and consider carefully all hazards before making decision.

Fourthly, equitization of some seaports help the corporation to collect the amount of money for repayment, take advantage of external resources (capital and knowledge) from investing new ships and facilities in seaports, thereby increasing the enterprise scalability and competitiveness in the market. Additionally, it is certain that debt settlement of Vinalines Corp. with huge debts cannot be just relied on the strength of DATC. Because the capital of DATC is limited while Vinalines Corp. is not the only customer of DATC.

Fifthly, selling ships help to reduce costs arising from the surplus of ship tonnage and the repair of old ships. Simultaneously, it could bring an amount of money for repayment or purchase of new ships.

Finally, divestment partially or completely from member units brings considerable revenues for the corporation to repay and reduce losses. However, the operating scale of the corporation thus will be narrowed. Moreover, the financial situation of divested companies could become worse if they cannot find any other financial resources to offset the fund withdrawn by the parent company.

In short, in the authorsÔÇÖ opinion, equitization, selling old ships and divestment are the most optimal solutions for Vinalines Corp. in the next development period due to their advantages. And this approach needs to be replicated as much as possible. The remaining methods, depending on each specific stage of development, could be considered for application.

4.3 Fleets

Over 80% of VinalinesÔÇÖ fleet by tonnage are dry and bulk carriers. Besides, the corporation possesses a large number of small old ships, which are operating inefficiently, thus incapable of meeting requirements of shippers or seized by foreign port authorities. Under the effects of the economic crisis, Vinalines Corp.ÔÇÖs fleet continuously posts losses in the recent years. The surplus of ship capacity also costs the corporation so much. Amid this backdrop, there is a need to reduce the number of unnecessary ships. In this sub-section, by applying the linear optimization and AIMMS software, the authors introduce the fleet optimization model, which help Vinalines Corp. to identify the minimum number of ships in need to be reduced during the period 2015 - 2020.

The objective of optimization is to reduce the number of unnecessary ships in order to pay debt and cut losses, but still ensure that capacity of the new fleet could meet the transportation demand in 2020, and operating costs of the new fleet are the minimum. Accordingly, Vinalines forecasted that transportation output of its fleet in 2015 could reach to 26.7 million tons; it could be increased appropriately 5% per annum from 2015 to 2020 and its tonnage will achieve about 34,076,718 tons in 2020. As of the end 2014, Vinalines Corp. possessed a fleet of 109 vessels with different types, namely container, dry carriers, bulk carriers, general carriers, and tankers.

However, we should consider some assumptions before applying any model. In this case, the authors assume as follows:

The average daily operating costs per ship in Vinalines Corp. in 2020 is the same with that in 2014,

The value of expected transport demand is of 34,076,718 tons,

The value of expected number of transport voyages of VinalinesÔÇÖ fleet in 2020 is the same with that in 2014,

The total necessary volume of fuel, crew, food, freshwaterÔÇŽ during a journey accounts for about 10% of the deadweight of a ship. At that time, we have the maximum transportation output on one binding of a voyage of a ship (MTO) equals 0.9 multiplied by DWT of a ship.

Expected coefficient taking advantage of tonnage on routes a ship operates, in case of forward journeys and inverse journeys are follows:

Table 3

|

Type of ship |

In forward journey |

In inverse journey |

|

Container ships |

80% |

90% |

|

Tankers |

80% |

80% |

|

Dry carriers |

80% |

85% |

|

Bulk carriers |

80% |

80% |

|

General carriers |

75% |

75% |

After determining all necessary data, the fleet optimization model is applied for the case of Vinalines Corp.ÔÇÖs fleet takes the following form:

Where:

ENS╬▒╬▓╔Ą = Expected number of a ship carrying cargo ╬▒ with size ╬▓ and age at specified time in the future

C╬▒╬▓╔Ą = Expected daily operating costs of a ship carrying cargo ╬▒ with size ╬▓ and age at specified time in the future

ANS╬▒╬▓╔Ą = Actual number of a ship carrying cargo ╬▒ with size ╬▓ and age at the time of calculation

ETD = Expected transport demand for shipping company's fleet at specified time in the future

TVC╬▒╬▓╔Ą = Total volume of cargo transported by a ship carrying cargo ╬▒ with size ╬▓ and age at specified time in the future

ETV╬▒╬▓╔Ą = Expected number of transport voyages per year at specified time in the future

MTO╬▒╬▓╔Ą = Maximum transport output in one journey of a voyage of a ship

a╬▒╬▓╔Ą = Expected coefficient taking advantage of tonnage on routes a ship operates, in case of forward journeys

b╬▒╬▓╔Ą = Expected coefficient taking advantage of tonnage on routes a ship operates, in case of inverse journeys

According to the solution attained from AIMMS software, 7 ships are recommended for selling or liquidation during 2015 - 2020, including:

-

ÔÇâÔŚő Dry Carriers

16´Ż×20 year old, 10,001´Ż×20,000 DWT type: 1 ship

Over 20 year old, 1´Ż×10,000 DWT type: 3 ships

Over 20 year old, 10,001´Ż×20,000 DWT type: 1 ship

-

ÔÇâÔŚő General carriers

Finally yet importantly, because demand for container transport is becoming more and more popular over the world due to many advantages, it brings to customers. Not to mention, dry bulk cargo market currently has no positive signs to recover. Therefore, in addition to consider selling inefficient ships, the authors also strongly recommend Vinalines Corp. to build more new bigger ships, especially container ships, in order to rejuvenate and increase the competitiveness of its fleet.

Conclusion

The purpose of this paper is to suggest alternatives for strengthening the competitiveness of a Vietnamese state-run shipping enterprise, namely Vinalines Corp., which is known as the largest ship-owner by tonnage in Vietnamese shipping industry. Accordingly, after giving the panoramic overview of the currently difficult development situation of Vietnam shipping industry and of Vinalines Corp., the authors analyze in detail advantages and disadvantages faced by Vinalines Corp. in recent years. After that, some alternatives which aim to overcome the CorporationÔÇÖs difficulties and strengthen its competitiveness for a sustainable development in the future will be proposed.

There are three methodologies applied in this paper. Linear optimization is used to solve the fleet optimization model to estimate the optimal size of VinalinesÔÇÖ fleet in the period of 2015 - 2020. Then, the AIMMS software is employed to solve the model. Finally, financial analysis is applied to assess the current financial situation of Vinalines Corp., before proposing alternatives to improve the situation.

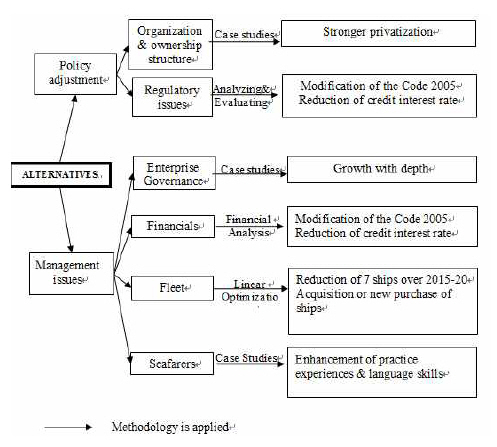

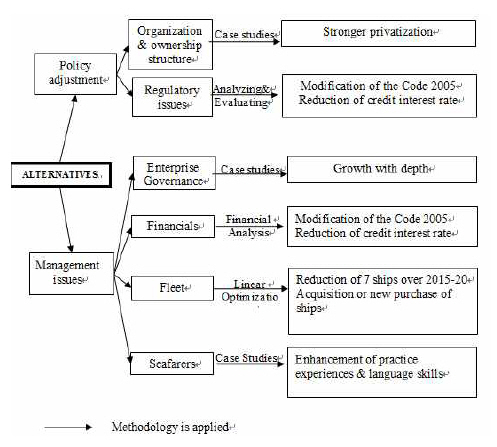

In short, besides objective factors as consequences of the economic crisis in 2008 - 2009 like low freight rate and scarcity of cargo to transport, the Vinalines Corp. is currently suffering from the high intervention of government, high debt and losses, inefficient fleet and low-quality seafarers. Through this paper, the authors argue that privatization is the key solution for every problem faced by the corporation at the present. It is also suggested that the number of over 16 year old dry carriers and general carriers should be reduced for VinalinesÔÇÖ better financial result. It is expected that the corporation could succeed its restructuring in near future as similar as Korea Shipping Corporation, NOL and Yangming. The Figure

2 summarizes the alternatives, applicable methods proposed in this paper as well as solutions indicated.

Fig. 2

Summary of alternatives, methodologies and suggestions to strengthen the competitiveness of Vinalines

This is the first academic research focusing on the competitiveness of Vinalines Corp. but has also limits of not analyzing the governmental policy in depth. The authors expect this limits to be overcome by the further study.

PDF Links

PDF Links PubReader

PubReader Full text via DOI

Full text via DOI Download Citation

Download Citation Print

Print