|

|

| J Navig Port Res > Volume 46(5); 2022 > Article |

|

ABSTRACT

The purpose of this study was to analyze whether the disposition effect, a behavioral finance theory, exists in decision-making for ship investment. A case study was adopted as the research methodology, and data obtained through narrative and questionnaire responses on decision-making for ship sales were analyzed from a behavioral finance perspective. The analysis found that the disposition effect had an impact on the decision to sell a vessel. The narrative responses revealed that some shipping companies tended to miss the opportunity to maximize ship sale profit because they sold their vessels readily and quickly before the price of the vessels had risen sufficiently. The questionnaire survey results indicated that the majority of the survey respondents chose to sell a ship whose price had risen slightly from the initial purchase price. Managers in charge of ship investment should examine whether the disposition effect exists in their decision-making when selling a ship.

From 2021, many container ship owners have gained huge profits from the sale of container ships as shown in the table 1 below.

Sea Consortium of Singapore purchased the 4,896 twenty foot equivalent unit (TEU)-wide beam X-PRESS JERSEY at USD 26.9 million in July 2019 and sold it to MSC in November 2021 at USD 105 million. It acquired more than three times profit from the purchase and sale of the ship. Cyprus Maritime was another winner. It purchased the 5,047 TEU CSL SANTA MARIA for merely USD 7.5 million in 2017 and sold it to MSC the ship for USD 68 million in 2021.

However, the first sellers of the ships and other ship-owners who disposed of the ships at inappropriate timings or in advance missed the opportunity to generate huge profits.

Individual stock investors tend to sell the stock immediately when a small profit margin occurs on the stock they purchased. However, when the price of the stock rises exponentially compared to the purchase price, individual investors often regret their decisions to sell the stock prematurely. This phenomenon in the stock market has been carefully studied by behavioral finance scholars. Odean(1998) argues that individual stock investors tend to sell stocks quickly that have made a small profit in market value and hold stocks for a longer period of time whose market price has fallen compared to the purchase price. Behavioral finance scholars have defined this phenomenon as the disposition effect.

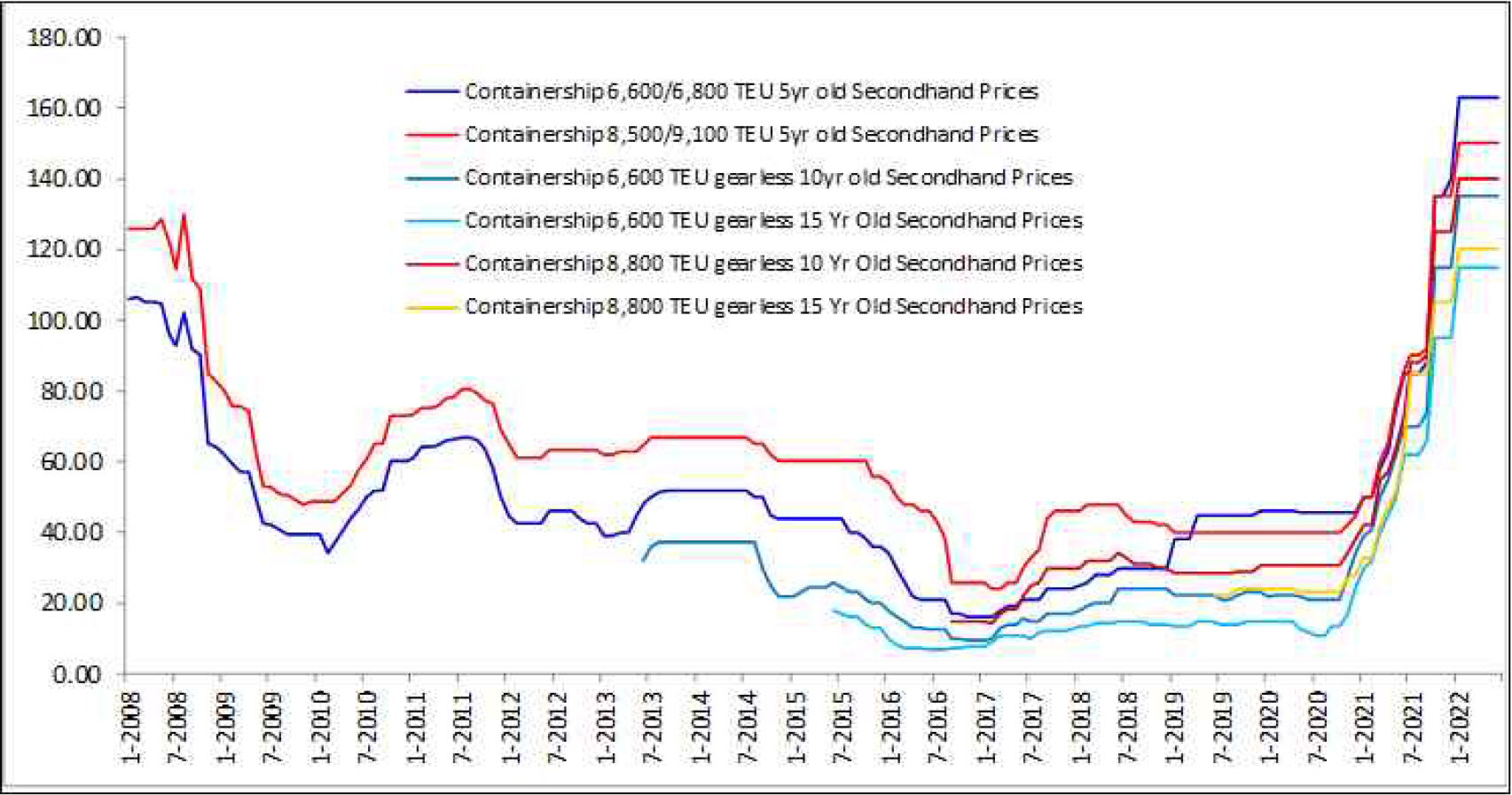

Ship prices for bulk carriers and container ships dropped to historic lows in 2016 and 2017 due to the continued recession in the shipping economy after the Lehman crisis. A number of Korean shipping companies purchased bulk carriers and container ships at low prices in the second-hand ship market in 2016 and 2017, and they financed ship financing from one of the Korean Public Ship Financiers (“KPSF”). As the price of the vessels rose slightly after purchasing the vessels, some shipping companies disposed of the container ships in 2018 and 2019 and prepaid the procured ship finance in advance. However, as shown in [Fig. 1], the prices of these vessels soared several times in 2021 and 2022.

Since the 2000s, behavioral economists have been awarded several Nobel Prizes in Economics. Traditional economics presupposes that humans are rational and pursue maximum benefit, but behavioral economics perceives people as beings who do not always make rational decisions (Baddeley, 2017; Chen et al., 2017).

Through the previously published papers, it is found that errors of behavioral finance affect decision-making regarding ship delivery (Kim and Lee, 2020), interest rate selection of ship finance procurement (Kim, 2021), and maturity selection of ship finance (Kim, 2022). Thus, it can be assumed that shipping companies miss the opportunity to generate huge profits from ship sales due to irrational decisions made by their CEO and managers, and that the errors of behavioral finance may have influenced the decision to sell the vessels at inappropriate timings.

This study conducts a case study to analyze how human psychological factors influence decision-making when selling a ship. It analyzes whether the disposition effect exists in the decision-making on ship sales and why some ship-owners dispose of their ships readily at inappropriate timings.

From the 1980s, psychology-based behavioral finance began to attract attention in academia. Behavioral finance clearly explains the phenomena related to finance that traditional finance cannot clarify (Baddeley, 2017; Camerer et al., 2004). Behavioral finance is a sub-discipline of behavioral economics that studies human behavior related to finance (Forbes, 2009). Ritter(2003) argued that behavioral finance is an appropriate discipline to study financial market inefficiency and human behavior related to finance. Traditional finance assumes that humans always make rational decisions, whereas behavioral finance assumes that humans do not always make rational decisions (Chen et al., 2017).

The disposition effect is a theory discovered in behavioral finance. This theory relates to the tendency of investors to sell assets that have risen in value and keep holding assets that have fallen in value. Especially in the stock market, people tend to sell more readily stocks whose prices are above their initial purchase price and hold stocks whose prices are below their initial purchase price.

Shefrin and Statman(1985) argued that investors tend to realize gains readily and quickly and hold losses for a longer period. They define this phenomenon as the disposition effect. They also argue that the disposition effect is caused by four main factors, which are prospect theory, mental accounting, seeking pride and avoiding regret, and self-control. Prospect theory is the theory that people tend to avoid risk in situations where they make a profit and take risks in situations where they lose. Secondly, investors make accounts in their minds on the gains and losses on each of their investment assets. This is called mental accounting. A reference point plays an important role in prospect theory and mental accounting, and generally, the reference point is the purchase price. Thirdly, investors are reluctant to recognize losses because they do not want to admit that their investment judgment is wrong. Conversely, once investment returns are created, they tend to quickly recognize revenue and close the account. Lastly, self-control is the control of one’s emotion and refers to emotional judgment control by analytical and rational judgment in the process of asset disposal.

Thaler and Johnson(1990) argued that people make decisions to break even when a loss occurs. From the results of their experiments, majority chose the decision that recovers a loss with 100% probability in a situation in which a loss has occurred. However, most of the participants in the experiment did not make a choice that had a possibility of incurring additional losses although there was a probability of earning much more than the amount of loss. On the contrary, if the profit that can be obtained with a 100% probability cannot cover the loss that has occurred, most of the experiment participants chose the decision that can recover the loss that has occurred while taking the risk of additional loss.

Odean(1998) analyzed 10,000 customer accounts to prove that the disposition effect exists. He contended that individual investors have a strong preference to sell winning investments quickly and readily, and hold losing investments for an extended period.

Heath et al. (1999) analyzed the decision-making regarding stock option exercise of 50,000 employees in 7 companies. Employees tended to actively exercise stock options above a certain reference point, which was generally the highest stock price among stock prices during the previous year.

Shapira and Venezia(2001) argued that both individual and professional investors are affected by the disposition effect through the analysis of stock investment conducted by Israeli stock investors in 1994. They insisted that through experience and training professional investors are much less affected by the disposition effect than individual investors are, but they are not completely free from it.

Grinblatt and Keloharju(2001) analyzed the Finnish stock market from the end of December 1994 to the beginning of January 1997 by controlling several factors. They argued that investors tend to hold the stock rather than sell it in both cases where it loses more than 30% of its purchase price, or loses less than 30% of its purchase price. On the other hand, they claim that investors tend to sell stocks when the stock’s return is higher than the previous week’s return or higher than the previous month’s return.

Cici (2012) studied the existence of the disposition effect by analyzing U.S. equity mutual funds. Cici (2012) argued that the disposition effect exists even in mutual funds operated by financial experts because individual investors redeem the funds.

Lee et al. (2013) analyzed the Taiwanese mutual fund data from 2001 to 2008 and studied the existence of the disposition effect in the Taiwanese mutual fund market. They showed that the disposition effect clearly existed in Taiwan mutual fund market.

Birru(2015) studied whether the disposition effect exists before and after stock split. Before the stock split, the disposition effect existed in individual investors’ stock trading, but after the stock split, it was found that the disposition effect decreased significantly. This is because the reference point is removed due to the stock split. Investors who bought stocks after the stock split had the disposition effect.

An et al. (2022) analyzed the disposition effect using the US and Chinese stock trading data. According to the results of the analysis, the disposition effect appears strongly when individual investors’ portfolios are making losses. This means that when the stock market crashes, the disposition effect occurs strongly among investors.

Andreu et al. (2020) analyzed whether the disposition effect exists using the Spanish stock market analysis. They argued that the disposition effect clearly exists in the Spanish stock market, and that it is particularly strong during stock market downturns and financial crisis. They emphasize that the disposition effect is stronger in the case of stocks with a low portfolio weighting in the stock portfolios.

As in the case of the stock market, it is presumed that a disposal effect also exists in the process of buying and selling ships. Prices for bulk carriers and container ships reached their lowest in 20 years in 2016, and between 2017 and 2020, ship prices rose slightly. However, since 2021, the price of ships has skyrocketed. Several shipowners who sold their ships prior to 2021 regretted their ship sales. It is suspected that the disposal effect, a theory of behavioral finance, may have influenced the decision to sell the vessels. In this paper, we will analyze whether the disposition effect affects the decision-making on ship sales.

This study analyzes ship sale decision-making with the disposition effect. The point of view of the decision-makers and management of ship sales and the managers of shipping companies should be considered. Therefore, the qualitative research method is suitable for this study.

In addition, narrative inquiry or case study is an appropriate qualitative research method if the subject and object of the study are related to humans or human behavior (Creswell, 2013). Assuming the research question is related to “how” or “why,” the case study method is one of the most appropriate research methods that can be applied (Hedrick et al., 1993).

A case study is a qualitative research method that considers, analyzes, and reviews the subject of study extensively and is a methodology suitable for describing, searching, or explaining phenomena occurring in real life. In addition, case studies are one of the most suitable research methods to improve understanding complex situations, behaviors, and cultural factors (Stake, 1995; Yin, 2014) and are universally used in social and life sciences (Yin, 2009). In business administration, case studies are mainly used to analyze the external influences and their impacts on a company, to understand the company’s strategies, decision-making, and interests, or to ascertain and develop optimal business cases (Klonoski, 2013; Bell et al., 2019).

Therefore, this study uses a qualitative case study method, narrative, and questionnaire responses to analyze and explain why the person responsible for ship sale in shipping companies makes decisions that miss the opportunity to realize a huge sale profit. In addition, this study examines whether ship sale decisions are explained by the disposition effect and infers whether the decision-making is rational or irrational.

One respondent from A Group, Respondent A, provided the narrative response. The participant in charge of the shipping finance and ship purchase and sale in A Group was the senior manager of the A Group. He did all negotiations with the KPSF about the ship financing and handled all ship purchase and sale of A Group’s ships. The question was as follows:

“After purchasing a number of ships from Hanjin Shipping in 2017, A Group procured ship finance with a 10-year maturity for the purpose of long-term operation. However, A Group sold some ships less than three years after the implementation of the long-term ship financing. Please explain the background behind the decision to sell the ships”

Narrative Respondent B, the Korean representative of a global ship broking company, provided a narrative response. Narrative Respondent B is a person who directly conducted the ship sale case described in the narrative response. The question was as follows:

The questionnaire’s question and multiple-choice answer were prepared based on previous behavioral finance studies. The question and answer were modified from questionnaires and statements used by behavioral finance scholars, and converted into a questionnaire and multiple-choice answer applicable for analyzing ship sale decisions.

The contents of the above [Table 2] are the actual questionnaire question and multiple-choice answers of the survey conducted for this study.

The survey was conducted over the course of eight weeks from February to April, in 2021. After completing the questionnaire on Google Forms, a text message was sent to the ship finance and shipping industry workers asking them to participate in the survey. A total of 82 workers participated in the survey. Most of the survey participants were industry practitioners and experts who had directly or indirectly experienced and performed ship finance-related work over a long period as employees in the shipping and ship finance industry. The details of the survey participants are shown above [Table 3].

As the bankruptcy of Hanjin Shipping was declared at the end of 2016, A Group took over the goodwill and remaining work force of Hanjin Shipping and started the container shipping business by establishing A Merchant Marine. When Hanjin Shipping went bankrupt, A Group purchased more than 20 ships, which were container ships and bulk carriers from Hanjin Shipping, and requested KPSF for ship financing with a 10-year maturity. The A Group manager in charge of ship finance and ship purchase and sale in stated that they planned to use the ships for a long time. KPSF eagerly provided ship finance to A Group with a long-term fixed low interest rate for container ships and bulk carriers. A Group started a liner containership business using the purchased ships. However, the recession in the shipping market continued and A Group continued to suffer losses.

Due to the increase in A Group’s debt ratio and operating losses, it decided to sell some of its vessels whose market-selling price was higher than the initial purchase price. By disposing of the vessels, A Group secured approximately KRW 10 billion in sale profit per ship. However, if the ships had been owned for two more years, A Group could have earned more than KRW 120 billion in sale profit per ship. The new buyers of the container vessels in Table 4 (column 9) experienced a huge increase in asset prices after purchasing the vessels whose price had increased.

However, the market price of the bulk carriers purchased by A Group at the same time as the above-mentioned container ships purchased from Hanjin Shipping in 2017 fell below the initial purchase price as shown in the [table 5] in 2019 and 2020, and A Group did not sell any bulk carriers at that time. Since then, the market price of the bulk carriers has risen in 2022, but only by a very small amount compared to the dramatic rise in container ship prices.

On the one hand, unless the boom has lasted for several years or the market has skyrocketed, it is not advisable to dispose of the vessel whose price has risen because the increase in the price of the vessel implies that the price of the vessel is on an upward trend. On the other hand, it is advantageous to dispose of the vessel whose price has fallen because it implies that the price of the vessel is on a downward trend. Hence, it is believed that A Group should have disposed of bulk carriers rather than container ships in order to secure liquidity in 2019 and 2020.

Finance scholars have proposed a momentum strategy in relation to stock investing. Since the stock price of a company that has risen tends to continue rising and, on the contrary, the stock price of a company that has fallen will tend to continue falling. Therefore, they argue that investment returns can be increased by using the momentum strategy of buying stocks whose price has risen and selling stocks whose price has fallen (Jegadeesh and Titman, 1993; Chan et al, 1996).

Unlike the A Group, another Korean shipping group, S Group, sold the container ships at the right time as shown in the table 6 below and realized a huge sale profit of more than 7 times higher than the initial purchase price.

According to Narrative Respondent A, A Group decided to solve the company’s liquidity problem by selling the container ships whose market price was higher than the initial purchase price at the time of purchase.

Shipowner E was earning operating profits after purchasing a container ship whose price was cut in half after the Lehman crisis. In 2017, the price of the vessel reached the lowest point of about USD 16.6M, and then gradually increased. Shipowner E sold the vessel to Korean shipping company K for USD 27 million in November 2020 when the price of the container vessel rose from its lowest point. However, after that, the price of the vessel rose to USD 140 million in 2022, and the ship owner E regretted the hasty decision to sell the vessel.

Investors want to avoid regrets over their investment decisions. Therefore, when the price of an invested asset rises slightly, investors quickly sell the asset to realize a profit because they fear the asset price will fall. Conversely, when the asset price declines, investors continue to hold the asset in the expectation that its price will rise (Barber and Odean, 1999).

The causes and effects listed in [Table 7] and in [Table 8] are typical of the disposition effect in the stock market discovered by behavioral finance scholars. The container shipping market had been in a recession for a long period (2009-2019), that is, since the ship prices and freight rates fell sharply after the Lehman crisis (2008), and it believed (2019) that there would be ample upside potential in container shipping market. However, Group A and shipowner E, who sold the vessels too early, missed the opportunity to earn a significant ship sale profit.

Using the questionnaire survey, the study analyzed whether the disposition effect exists in the case of ship sale. It was assumed that a shipping company is going to sell one debt-free vessel in order to secure funds in a liquidity crisis; the survey respondents were asked which vessel they would choose.

According to the survey results shown in [Fig. 2] below, it is found that the disposition effect exists in decision-making on the sale of ships. Of the 82 survey respondents, 64 answered that they dispose of a ship whose market price is higher than the purchase price.

According to the momentum effect (Jegadeesh and Titman, 1993; Chan et al, 1996), the risen price of a vessel is more likely to continue rising because the ship price is on an upward trend and the fallen price of a vessel is more likely to continue falling because the ship price is on a downtrend. Therefore, in order to maximize profits, it is advisable to purchase a vessel whose price has risen and to dispose of a vessel whose price has fallen. However, 78% of the survey respondents chose to sell a ship whose current market price rises slightly higher than the initial purchase price of the ship.

Most people are distressed to admit poor decision-making. Investors tend to be reluctant to sell an investment asset that incurs a loss because they prefer to procrastinate acknowledging a loss in an investment. Contrarily, they tend to realize quickly returns on investment assets that generate profit in order to prove that their investment decision-making is correct (Shefrin and Statman, 1985).

Shipping companies and ship investment institutions purchase ships at low prices during a shipping recession and seek profits from the sale of ships. However, it takes a long time for the price of a vessel to rise sufficiently, and if the recession continues after purchasing the vessel, decision-makers tend to sell the vessel quickly despite an insufficient profit margin.

After the Lehman crisis in 2008, the container shipping market remained in recession, reaching its lowest point in 2016. Therefore, in 2016 and 2017, many investors bought many container ships at low prices. In 2018 and 2019, when the price of container ships slightly rebounded, some investors realized a small sale profit by selling the container ships they had bought cheaply. However, the early sale of ship assets that is operating the shipping business has resulted in a loss of opportunity to maximize profits in the boom of 2021 to 2022.

Investors tend to realize the return on their investment and close the investment account as soon as a small profit occurs to avoid criticism regarding their investment judgment (Shefrin and Statman, 1985).

Owing to analyzing the narrative responses and the questionnaire responses, it is found that there is a disposition effect on the decision-making of the ship sales and that there are cases in which the opportunity of huge sales profits is missed due to the early sale of the vessels. These decisions are difficult to evaluate as rational and wise decisions.

The disposition effect can have a doubly detrimental effect on the returns of investors. One is that an asset that has risen in price can be sold off prematurely, even though it has the potential to rise further, thus forgoing opportunities for additional income. The second is that holding assets that have fallen in price can increase the likelihood of further losses because of fear of loss. The disposition effect can lead to the worst case of not earning much profit and causing more losses. Therefore, the disposition effect may be a detrimental behavioral financial error for investors.

When operating a shipping company or investing in ships, there are cases in which it is necessary to dispose of the owned ships due to management difficulties or liquidity problems. In this case, rather than simply selling a ship whose market price is higher than the purchase price, it is necessary to ensure not to miss an opportunity to maximize future profits through careful market analysis.

Many scholars have proven that the disposition effect exists in stock market. It is confirmed that the disposition effect exists in the shipping market as well, and it is determined that this is because the decision-maker behaves the same way as the stock investor.

Table 1.

Container Ship Sales in 2021

(USD, Million)

Table 2.

Survey - Disposition Effect

Table 3.

Participants in survey responses

(Unit: No, %)

Table 4.

Ship sales of Hanjin Shipping-Container ships

(USD, Million)

Table 5.

Ship sales of Hanjin Shipping - Bulk carriers

(USD, Million)

Table 6.

S Group’s container ship sales

(USD, Million)

Source: www.vesselsvalue.com

Table 7.

Narrative response analysis - A Group

Table 8.

Narrative response analysis - Shipowner E

References

1 An, L., Engelberg, J., Henriksson, M., Wang, B. and Williams, J.(2022), “The Portfolio-Driven Disposition Effect”, PBCSF-NIFR Research Paper.

2 Andreu, L, Ortiz, C and Sarto, JL(2020), “Disposition effect in fund managers. Fund and stock-specific factors and the upshot for investors”, Journal of Economic Behavior & Organization, Vol. 176, pp. 253-268.

3 Baddeley, M(2017), Behavioural Economics: A Very Short Introduction. 1st ed. Oxford University Press.

4 Barber, BM and Odean, T(1999), “The Courage of Misguided Convictions: The Trading Behavior of Individual Investors”, Financial Analyst Journal, Vol. 55, No. 6, pp. 41-55.

5 Bell, E, Bryman, A and Harley, B(2019), Business Research Methods. 5th ed. New York: Oxford University Press.

6 Birru, J(2015), “Confusion of Confusions:” A Test of the Disposition Effect and Momentum”, The Review of Financial Studies, Vol. 28, No. 7, pp. 1849-1873.

7 Camerer, CF, Loewenstein, G and Rabin, M(2004), Advances in Behavioral Economics. New Jersey: Princeton University Press.

8 Chan, LKC, Jegadeesh, N and Lakonishok, J(1996), “Momentum Strategies”, Journal of Finance, Vol. 51, No. 5, pp. 1681-1713.

9 Chen, CS, Cheng, JC, Lin, FC and Peng, C(2017), “The Role of House Money Effect and Availability Heuristic in Investor Behaviour.” Management Decision, Vol. 55, No. 8, pp. 1598-1612.

10 Cici, G(2012), “The Prevalence of the Disposition Effect in Mutual Funds’ Trades”, Journal of Financial and Quantitative Analysis, Vol. 47, No. 4, pp. 795-820.

11 Creswell, JW(2013), Qualitative Inquiry and Research Design: Choosing Among Five Approaches. 3rd Edition. SAGE Publications Inc.

12 Forbes, W(2009), Behavioural Finance. West Sussex: John Wiley & Sons Ltd.

13 Grinblatt, M and Keloharju, M(2001), “What Makes Investors Trade?” Journal of Finance, Vol. 56, No. 2, pp. 589-616.

14 Heath, C, Huddart, S and Lang, M(1999), “Psychological Factors and Stock Option Exercise”, The Quarterly Journal of Economics, Vol. 114, No. 2, pp. 601-627.

15 Hedrick, TE, Bickman, L and Rog, DJ(1993), Applied Research Design. SAGE Publications Inc.

16 Jegadeesh, N and Titman, S(1993), “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency”, The Journal of Finance, Vol. 48, No. 1, pp. 65-91.

17 Kim, WS(2021), “Fixed Versus Floating Interest Rates in Shipping Finance: A Behavioral Finance Perspective”, Journal of Navigation and Port Research, Vol. 45, No. 5, pp. 259-275.

18 Kim, WS(2022), “Analysis of the Maturity Selection on Ship Finance: A Behavioral Finance Perspective”, Journal of Navigation and Port Research, Vol. 46, No. 2, pp. 121-133.

19 Kim, WS and Lee, KH(2020), “The Effect of Sunk Cost and Anchoring Effect on Shipping Finance”, Journal of Navigation and Port Research, Vol. 44, No. 4, pp. 326-337.

20 Klonoski, R(2013), “The Case for Case Studies: Deriving Theory from Evidence”, Journal of Business Case Studies, Vol. 9, No. 3, pp. 261-266.

21 Lee, JS, Yen, PH and Chan, KC(2013), “Market states and disposition effect: evidence from Taiwan mutual fund investors”, Applied Economics, Vol. 45, No. 10, pp. 1331-1342.

22 Odean, T(1998), “Are Investors Reluctant to Realize Their Losses?” The Journal of Finance, Vol. 53, No. 5, pp. 1775-1798.

24 Shapira, Z and Venezia, I(2001), “Patterns of Behavior of Professionally Managed and Independent Investors”, Journal of Banking & Finance, Vol. 25, No. 8, pp. 1573-1587.

25 Shefrin, H and Statman, M(1985), “The disposition to sell winners too early and ride losers too long: Theory and evidence”, Journal of Finance, Vol. 40, No. 3, pp. 777-790.

26 Stake, R(1995), The Art of Case Study Research. Los Angeles, California: Sage.

27 Thaler, RH and Johnson, EJ(1990), “Gambling with the House Money and Trying to Break Even: The Effects of Prior Outcomes on Risky Choice”, Management Science, Vol. 36, No. 6, pp. 643-660.

28 Yin, RK(2009), Case Study Research: Design and Methods. 4th ed. Thousand Oaks, CA: Sage.

29 Yin, RK(2014), Case Study Research: Designs and Methods. Los Angeles, California: Sage.

- TOOLS

-

METRICS

-

- 0 Crossref

- 0 Scopus

- 2,027 View

- 15 Download

- Related articles

-

Detection of Ship Movement Anomaly using AIS Data: A Study2018 August;42(4)

PDF Links

PDF Links PubReader

PubReader ePub Link

ePub Link Full text via DOI

Full text via DOI Download Citation

Download Citation Print

Print