|

|

| J Navig Port Res > Volume 46(3); 2022 > Article |

|

мҡ” м•Ҫ

ліё м—°кө¬мқҳ лӘ©м ҒмқҖ мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„мқҳ мғҒкҙҖкҙҖкі„ л°Ҹ мҳҒн–Ҙл Ҙмқ„ кІҖмҰқн•ҳлҠ” кІғмқҙлӢӨ. нғ„мҶҢл°°м¶ң к°җ축мқ„ мң„н•ҙ м„қмң мқҳмЎҙлҸ„лҘј мӨ„мқҙкі м№ңнҷҳкІҪм—°лЈҢ м„ л°•мқҳ к°ңл°ңмқҙ 추진лҗҳкі мһҲм§Җл§Ң, нҳ„мһ¬мқҳ 진н–үмғҒнҷ©мңјлЎң ліј л•Ң, мғҒлӢ№н•ң мӢңк°„мқҙ н•„мҡ”н• кІғмңјлЎң ліҙмқёлӢӨ. л°ҳл©ҙ, COVID 19 нҢ¬лҚ°лҜ№ л°Ҹ лҹ¬мӢңм•„мқҳ мҡ°нҒ¬лқјмқҙлӮҳ м№Ёкіөм—җ л”°лҘё мң к°Җ ліҖлҸҷм„ұмқҙ м»Өм§Җкі мһҲлӢӨ. н•ҙмҡҙм—…м—җм„ң м—°лЈҢ비мҡ©мқҙ нҒ° 비мӨ‘мқ„ м°Ём§Җн•ҳкі мһҲмңјлҜҖлЎң, мң к°Җк°Җ мҡҙмһ„м—җ м–ҙл– н•ң мҳҒн–Ҙмқ„ мЈјлҠ”м§Җ м җкІҖмқҙ н•„мҡ”н•ҳлӢӨ. мң к°Җ ліҖмҲҳлЎң Brent, Dubai, WTI к·ёлҰ¬кі мҡҙмһ„ліҖмҲҳлҠ” BDI, BCI, BPIлЎң 2008л…„ 10мӣ”л¶Җн„° 2022л…„ 2мӣ”к№Ңм§Җ мӣ”лі„ лҚ°мқҙн„°лҘј мӮ¬мҡ©н•ҳмҳҖлӢӨ. VAR(Vector Autoregressive) лӘЁнҳ•мқ„ мқҙмҡ©н•ң мғҒкҙҖкҙҖкі„ 분м„қм—җм„ң BDIм—җ лҢҖн•ң 충격л°ҳмқ‘ 분м„қмқҖ WTIк°Җ к°ҖмһҘ нҒ° мҳҒн–Ҙмқ„ лҜёміӨкі , к·ё лӢӨмқҢмңјлЎң л‘җл°”мқҙмң , лёҢл ҢнҠёмң мҲңмңјлЎң м°ЁмқҙлҘј ліҙмҳҖлӢӨ. мҳҲмёЎмҳӨм°Ё 분мӮ°л¶„н•ҙ 분м„қкІ°кіјлҠ” BDIм—җ лҢҖн•ҙ WTI, л‘җл°”мқҙмң , лёҢл ҢнҠёмң мҲңмңјлЎң м„ӨлӘ…л Ҙмқҳ м°ЁмқҙлҘј ліҙмҳҖлӢӨ. м„ мў…лі„лЎң м°ЁмқҙлҠ” мһҲмңјлӮҳ, лҢҖмІҙлЎң WTIмҷҖ л‘җл°”мқҙмң к°Җ м„ӨлӘ…л Ҙмқҙ лҶ’м•ҳлӢӨ.

ABSTRACT

The purpose of this study was to investigate the inter-correlation between crude oil prices and Dry Bulk Freight rates. Eco-friendly shipping fuels has being actively developed to reduce carbon emission. However, carbon neutrality will take longer than anticipated in terms of the present development process. Because of OVID-19 and the Russian invasion of Ukraine, crude oil price fluctuation has been exacerbated. So we must examine the impact on Dry Bulk Freight rates the oil prices have had, because oil prices play a major role in shipping fuels. By using the VAR (Vector Autoregressive) model with monthly data of crude oil prices (Brent, Dubai and WTI) and Dry Bulk Freight rates (BDI, BCI and (BPI) 2008.10вҲј2022.02, the empirical analysis documents that the oil prices have an impact on Dry bulk Freight rates. From the analysis of the forecast error variance decomposition, WTI has the largest explanatory relationship with the BDI and Dubai ranks seoond, Brent ranks third. In conclusion, WTI and Dubai have the largest impact on the BDI, while there are some differences according to the ship-type.

м§Җкө¬ мҳЁлӮңнҷ”мқҳ мЈјлІ”мңјлЎң нғ„мҶҢк°Җ м§ҖлӘ©лҗҳл©ҙм„ң нғ„мҶҢл°°м¶ңмқ„ к°җ축н•ҳл ӨлҠ” л…ёл Ҙмқҙ м „ м§Җкө¬м ҒмңјлЎң м „к°ңлҗҳкі мһҲлӢӨ. н•ҙмҡҙмӮ°м—…м—җм„ңлҸ„ нғ„мҶҢл°°м¶ңмқҳ к°җ축 л°©м•ҲмңјлЎң м№ңнҷҳкІҪ м—°лЈҢ м„ л°•м—җ лҢҖн•ң к°ңл°ңмқҙ нҷңл°ңнһҲ 추진лҗҳкі мһҲлӢӨ. к·ёлҹ¬лӮҳ нҳ„мһ¬ 진н–үлҗҳкі мһҲлҠ” м№ңнҷҳкІҪм—җл„Ҳм§Җм—җ лҢҖн•ң кё°мҲ к°ңл°ң нҳ„нҷ© л°Ҹ нҲ¬мһҗ 진н–ү мҶҚлҸ„лҘј к°җм•Ҳн• л•Ң, мҷ„м „н•ң м№ңнҷҳкІҪ м—җл„Ҳм§Җ мІҙм ңлЎң м „нҷҳн•ҳлҠ”лҚ° мғҒлӢ№н•ң мӢңк°„мқҙ н•„мҡ”н• кІғмңјлЎң ліҙмқёлӢӨ. л”°лқјм„ң лӢ№л¶„к°„ м„қмң м—°лЈҢм—җ лҢҖн•ң мқҳмЎҙлҸ„лҠ” мқјм • кё°к°„ м§ҖмҶҚлҗ л“Ҝн•ҳлӢӨ.

British Petroleumмқҳ 2021л…„лҸ„ м„ёкі„ м—җл„Ҳм§Җ нҶөкі„мһҗлЈҢм—җ л”°лҘҙл©ҙ, кёҖлЎңлІҢ м—җл„Ҳм§Җ лҜ№мҠӨм—җм„ң м„қмң мқҳ 비мӨ‘мқҙ 2020л…„м—җ 31.3%лЎң м „л…„лҸ„ 33.0%м—җ 비н•ҙ мҶҢнҸӯ н•ҳлқҪн•ҳмҳҖлӢӨ. 1970л…„лҢҖ м„қмң мқҳмЎҙлҸ„ 50%м—җ 비н•ҳл©ҙ 30%лҢҖлЎң 축мҶҢлҗҳм—ҲлӢӨ. к·ёлҹ¬лӮҳ мөңк·ј л“Өм–ҙ, м„қмң 비мӨ‘ к°җмҶҢ мҶҚлҸ„к°Җ м •мІҙнҳ„мғҒмқ„ ліҙмқҙкі мһҲлӢӨ. мһ¬мғқм—җл„Ҳм§Җмқҳ 비мӨ‘мқҖ 2020л…„ 5.7%м—җ л¶Ҳкіјн•ҳкі мҰқк°Җ мҶҚлҸ„ м—ӯмӢң л§Өмҡ° лҠҗлҰ¬кІҢ 진н–үлҗҳкі мһҲлӢӨ. м—җл„Ҳм§ҖкІҪм ңм—°кө¬мӣҗ(2022)м—җ мқҳн•ҳл©ҙ 2022л…„ м„ёкі„ м„қмң мҲҳмҡ”лҠ” кІҪм ңм„ұмһҘкіј н•Ёк»ҳ мҪ”лЎңлӮҳ19 мқҙм „ мҲҳмӨҖмңјлЎң нҡҢліөн• кІғмңјлЎң м „л§қн•ҳкі мһҲлӢӨ. лҳҗн•ң лҹ¬мӢңм•„мқҳ мҡ°нҒ¬лқјмқҙлӮҳ м№ЁкіөмңјлЎң мқён•ҙ м „л°ҳм Ғмқё м—җл„Ҳм§Җ мҲҳкёүмқҳ л¬ём ңк°Җ л¶Җк°ҒлҗЁм—җ л”°лқј мң к°Җ ліҖлҸҷм„ұмқ„ мӨ„мқҙкё° мң„н•ҙ OPCE+мқҳ м„қмң мғқмӮ° 비мӨ‘мқҙ м–ҙлҠҗ м •лҸ„ мҰқк°Җн• к°ҖлҠҘм„ұлҸ„ мһҲлҠ” кІғмңјлЎң ліҙкі н•ҳкі мһҲлӢӨ.

лҜёкөӯ м—°л°©мқҖн–ү(Federal Reserve Bank)м—җ л”°лҘҙл©ҙ, мң к°Җк°Җ л°°лҹҙлӢ№ U$10мқҙ мғҒмҠ№н•ҳл©ҙ лҜёкөӯмқҳ кІҪм ңм„ұмһҘмқҖ 0.1% к°җмҶҢн•ҳкі , мқён”Ңл Ҳмқҙм…ҳмқҖ 0.2% мғҒмҠ№н•ңлӢӨкі м¶”м •н•ҳмҳҖлӢӨ. мң лҹҪ мӨ‘м•ҷмқҖн–ү(European Central Bank)мқҖ мң к°Җк°Җ 10% мғҒмҠ№н•ҳл©ҙ мң лЎңмЎҙмқҳ мқён”Ңл Ҳмқҙм…ҳмқҖ 0.1%м—җм„ң 0.2% мғҒмҠ№н•ңлӢӨкі л°қнҳ”лӢӨ(Cristina and Luciani, 2017).

м„ л°• м—°лЈҢм—җ мһҲм–ҙм„ңлҸ„ м№ңнҷҳкІҪ лҢҖмІҙм—°лЈҢ к°ңл°ңм—җ лҢҖн•ң л…ёл ҘмқҖ м§ҖмҶҚн•ҳкі мһҲм§Җл§Ң, лӢ№л¶„к°„ м„қмң м—җ лҢҖн•ң мқҳмЎҙлҸ„лҠ” мң м§Җлҗ м „л§қмқҙлӢӨ. мң к°Җк°Җ кёҖлЎңлІҢ кІҪм ңнҷңлҸҷ м „л°ҳм—җ лҜём№ҳлҠ” мҳҒн–Ҙмқҙ нҒ¬кі , м—°лЈҢ비 비мӨ‘мқҙ лҶ’мқҖ н•ҙмҡҙм—…м—җ нҒ° мҳҒн–Ҙмқ„ лҜём№ҳлҜҖлЎң мң к°Җмқҳ мҡҙмһ„м—җ лҢҖн•ң мҳҒн–Ҙл Ҙмқ„ м җкІҖн•ҳлҠ” кІғмқҖ н•„мҡ”н•ҳлӢӨ.

ліё м—°кө¬м—җм„ңлҠ” VARлӘЁнҳ•мқ„ нҶөн•ҙ мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„мқҳ мғҒкҙҖкҙҖкі„мҷҖ мҳҒн–Ҙл Ҙмқ„ 분м„қн•ҳмҳҖлӢӨ. м„ӨлӘ…ліҖмҲҳлЎң 3к°ңмқҳ көӯм ң мӣҗмң к°ҖкІ©мқё лёҢл ҢнҠёмң , л‘җл°”мқҙмң л°Ҹ м„ңл¶Җн…ҚмӮ¬мҠӨ мӨ‘м§Ҳмң (WTI)лҘј лӘЁл‘җ мӮ¬мҡ©н•ҳмҳҖкі , мў…мҶҚліҖмҲҳлҠ” лІҢнҒ¬м„ мҡҙмһ„мқҳ мў…н•©м§ҖмҲҳмқё Baltic Dry Index(BDI)мҷҖ м„ л°• мӮ¬мқҙмҰҲлі„лЎң мјҖмқҙн”„мӮ¬мқҙмҰҲ м„ л°•мқҳ мҡҙмһ„м§ҖмҲҳмқё Baltic Capesize Index(BCI) к·ёлҰ¬кі Baltic Panamax Index(BPI)лҘј мӮ¬мҡ©н•ҳмҳҖлӢӨ. мјҖмқҙн”„мҷҖ нҢҢлӮҳл§үмҠӨ мӢңмһҘмқҖ кұ°мӢңкІҪм ң ліҖмҲҳм—җ лҜјк°җн•ҳкІҢ л°ҳмқ‘н•ҳкі , мҷ„м „кІҪмҹҒм—җ к°Җк№Ңмҡҙ мӢңмһҘ нҠ№м„ұмқ„ ліҙмқҙкё° л•Ңл¬ём—җ кІҪм ңмғҒнҷ©мқ„ м„ӨлӘ…н•ҳкұ°лӮҳ мҳҲмёЎн•ҳлҠ”лҚ° мў…мў… мӮ¬мҡ©лҗҳлҠ” мҡҙмһ„ м§ҖмҲҳмқҙлӢӨ. лҚ°мқҙн„°лҠ” кёҖлЎңлІҢ кёҲмңөмң„кё° л°ңмғқ мқҙнӣ„мқё 2008л…„ 10мӣ”л¶Җн„° 2022л…„ 2мӣ”к№Ңм§Җ мӣ”лі„лҚ°мқҙн„°лҘј мӮ¬мҡ©н•ҳмҳҖлӢӨ. лҸҷ кё°к°„лҚ°мқҙн„°лҘј мӮ¬мҡ©н•ң мқҙмң лҠ” 2008л…„ кёҖлЎңлІҢ кёҲмңөмң„кё°лҠ” н•ҙмҡҙмӢңмһҘм—җ л§үлҢҖн•ң мҳҒн–Ҙмқ„ лҜёміӨкі к·ё мҳҒн–Ҙл Ҙмқҙ м§ҖмҶҚлҗҳкі мһҲмңјл©°, 2008л…„ мқҙнӣ„мқҳ лҚ°мқҙн„°к°Җ мӢңмһҘмғҒнҷ©м—җ лҢҖн•ҙм„ң лҚ” м •нҷ•н•ң кІ°кіјлҘј лӮҳнғҖлӮҙкё° л•Ңл¬ёмқҙлӢӨ(Dai et al., 2016).

ліё м—°кө¬лҠ” лӢӨмқҢкіј к°ҷмқҙ кө¬м„ұн•ҳмҳҖлӢӨ. 1мһҘ м„ңлЎ м—җ мқҙм–ҙ 2мһҘмқҖ м„ н–үм—°кө¬лҘј нҶөн•ҙ мң к°ҖмҷҖ лӢӨм–‘н•ң кІҪм ңліҖмҲҳл“Өмқҙ лІҢнҒ¬м„ мҡҙмһ„м—җ лҜём№ҳлҠ” мҳҒн–Ҙм—җ лҢҖн•ҙ мӮҙнҺҙліҙм•ҳлӢӨ. 3мһҘм—җм„ңлҠ” ліё м—°кө¬мқҳ 분м„қл°©лІ•мқё VAR лӘЁнҳ•мқ„ м–ҙл–»кІҢ м Ғмҡ©н•ҳмҳҖлҠ”м§Җ м„ӨлӘ…н•ңлӢӨ. 4мһҘмқҖ мӢӨмҰқ분м„қ лӮҙмҡ©мқ„ м„ӨлӘ…н•ҳкі мң к°Җмқҳ лІҢнҒ¬м„ мҡҙмһ„м—җ лҜём№ҳлҠ” мҳҒн–Ҙмқ„ 분м„қн•ҳмҳҖкі , 5мһҘм—җм„ң м—°кө¬мқҳ кІ°лЎ л°Ҹ мӢңмӮ¬м җмқ„ м ңмӢңн•ҳмҳҖлӢӨ.

лІҢнҒ¬м„ мӢңмһҘмқҳ лҸҷнғңм Ғ нҠ№м„ұмқ„ нҢҢм•…н•ҳкё° мң„н•ҙ Rim et al.(2010)мқҖ мҲҳмҡ”(мҡҙмҶЎлҹү), кіөкёү(м„ л°•лҹү), к°ҖкІ©(мҡҙмһ„) ліҖмҲҳлҘј лІЎн„°мһҗкё°нҡҢк·Җ лӘЁнҳ•(Vector Autoregressive Model, VAR)мқ„ мӮ¬мҡ©н•ҳм—¬ 분м„қн•ҳмҳҖлӢӨ. лҸҷ м—°кө¬м—җм„ң мҡҙмҶЎлҹү 충격мқҖ м„ л°•лҹү ліҖмҲҳм—җ мҳҒн–Ҙмқ„ лҜём№ҳлҠ” л°ҳл©ҙ, м„ л°•лҹү 충격мқҖ мҡҙмҶЎлҹү ліҖмҲҳм—җ мҳҒн–Ҙмқ„ лҜём№ҳм§Җ м•ҠлҠ” кІғмңјлЎң лӮҳнғҖлӮ¬лӢӨ. лІҢнҒ¬м„ мҡҙмһ„мқҙ мӨ‘кі м„ к°Җм—җ лҜём№ҳлҠ” мҳҒн–Ҙмқ„ VAR лӘЁнҳ•мңјлЎң 분м„қн•ң м—°кө¬(Kim et al., 2014)м—җм„ңлҠ” м„ л №мқҙ лҶ’мқҖ м„ л°•(10л…„)ліҙлӢӨ м„ л №мқҙ лӮ®мқҖ м„ л°•(5л…„) к·ёлҰ¬кі м„ л°•мқҳ нҒ¬кё°к°Җ нҒ° capesize м„ л°•мқҙ panamax м„ л°•ліҙлӢӨ мҡҙмһ„ліҖлҸҷм—җ нҒ¬кІҢ л°ҳмқ‘н•ҳлҠ” кІғмңјлЎң лӮҳнғҖлӮ¬лӢӨ.

көӯм ңмң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„(BDI, BCI л°Ҹ BPI)кіјмқҳ мһҘкё° к· нҳ•кҙҖкі„м—җ лҢҖн•ҙ Chung and Kim(2011)мқҖ л‘җл°”мқҙ мң к°ҖлҘј кё°мӨҖмңјлЎң 2000.01вҲј2011.02 кё°к°„ лҚ°мқҙн„°лҘј нҶөн•ҙ 분м„қн•ҳмҳҖлӢӨ. ліҖмҲҳл“Өмқҳ лӢЁмң„к·ј кІҖм •мқ„ нҶөн•ҳм—¬ м•Ҳм •м„ұмқҙ нҷ•ліҙлҗҳм§Җ лӘ»н•ҳкі кіөм Ғ분кҙҖкі„к°Җ м—Ҷмңјл©ҙ VARмқ„ мӮ¬мҡ©н•ҳкі , кіөм Ғ분мқҙ мЎҙмһ¬н•ңлӢӨл©ҙ лІЎн„°мҳӨм°ЁмҲҳм • лӘЁнҳ•(Vector Error Correction Model, VECM)мқ„ мӮ¬мҡ©н•ҙм•ј н•ңлӢӨ. лҸҷ м—°кө¬м—җм„ңлҠ” көӯм ңмң к°ҖмҷҖ BDI, BCI, BPIк°„м—җ к°Ғк°Ғмқҳ кіөм Ғ분кҙҖкі„к°Җ мЎҙмһ¬н•ҳм§Җ м•ҠлҠ” кІғмңјлЎң лӮҳнғҖлӮҳ, VAR лӘЁнҳ•мқ„ мӮ¬мҡ©н•ҳмҳҖлӢӨ. 분м„қкІ°кіј, мң к°ҖлҠ” BDIмҷҖ BCIм—җ м •(+)мқҳ мң мқҳм Ғ нҡЁкіјлҘј к°–кі BPIм—җлҠ” мӢңк°„мқҙ кІҪкіјн•Ём—җ л”°лқј мқҢ(-)мқҳ мң мқҳм Ғ нҡЁкіјлҘј к°–лҠ”лӢӨкі л°қнҳ”лӢӨ.

Hasan et al.(2021)лҠ” кө¬мЎ° лІЎн„°мһҗкё°нҡҢк·Җ лӘЁнҳ•(Structural VAR, SVAR)мқ„ кё°л°ҳмңјлЎң COVID-19 нҢ¬лҚ°лҜ№мқҙ мӢӨл¬јкІҪм ң, мЈјмӢқмӢңмһҘ л°Ҹ м—җл„Ҳм§Җ л¶Җл¬ём—җ лҜём№ң нҢҢкёүнҡЁкіј(spillovers)лҘј м—°кө¬н•ҳмҳҖлӢӨ. мў…мҶҚліҖмҲҳлЎң BDI, MSCI world index(MSCI) л°Ҹ MSCI world energy index(MSCIE)лҘј мӮ¬мҡ©н•ҳм—¬ 분м„қн•ң кІ°кіј, COVID-19мқҖ мӢӨл¬јкІҪм ңліҙлӢӨ мЈјмӢқмӢңмһҘм—җ лҚ” нҒ° мҳҒн–Ҙмқ„ лҜёміӨлӢӨ. лҸҷ м—°кө¬м—җм„ң SVAR лӘЁнҳ•мқ„ мӮ¬мҡ©н•ң мқҙмң лҠ” кұ°мӢңкІҪм ң 충격(macroeconomic shocks)м—җ л”°лҘё кІҪм ңм Ғ нҢҢкёүнҡЁкіјлҘј м„ӨлӘ…н•ҳлҠ”лҚ° SVAR лӘЁнҳ•мқҙ нғҒмӣ”н•ҳкё° л•Ңл¬ёмқҙлқјкі м„ӨлӘ…н–ҲлӢӨ.

Kim and Chang(2013)мқҖ мң к°Җ ліҖмҲҳлЎң н•ҙмҡҙмӮ¬мқҳ кІҪмҳҒм—җ м§Ғм ‘м Ғмқё мҳҒн–Ҙмқ„ лҜём№ҳлҠ” лІҷм»Өк°ҖкІ©мқ„ мӮ¬мҡ©н•ҳм—¬ BDIмҷҖмқҳ кҙҖкі„лҘј 비лҢҖм№ӯ кіөм Ғ분 кІҖм • лӘЁнҳ•мңјлЎң 분м„қн•ҳмҳҖлӢӨ. BDIмҷҖ лІҷм»Ө к°ҖкІ© к°„м—җ мһҘкё° к· нҳ•кҙҖкі„к°Җ мЎҙмһ¬н•ҳм§Җ м•ҠлҠ” л°ҳл©ҙм—җ BDIмқҳ лІҷм»Ө к°ҖкІ©м—җ лҢҖн•ң мҳҒн–Ҙмқҙ нҶөкі„м ҒмңјлЎң мң мқҳм„ұмқҙ лҶ’мқҖ кІғмңјлЎң лӮҳнғҖлӮҳ, л‘җ ліҖмҲҳ к°„м—җ 비лҢҖм№ӯ мһҘкё° к· нҳ•кҙҖкі„к°Җ мЎҙмһ¬н•ңлӢӨкі л°қнҳ”лӢӨ.

Jeon and Yang(2016)мқҖ м„ёкі„ мЈјмҡ” м„ мӮ¬мқҳ м„ л°• л°ңмЈјлҹүкіј н•ҙмҡҙ мҡҙмһ„мқҳ мғҒкҙҖкҙҖкі„лҘј к·ёлһңм Җ мқёкіјкҙҖкі„(granger causality analysis) лӘЁнҳ•мңјлЎң 분м„қн•ҳм—¬ м„ л°•л°ңмЈјк°Җ мҡҙмһ„м—җ м–јл§ҲлӮҳ мҳҒн–Ҙмқ„ мЈјлҠ”м§Җ к·ёлҰ¬кі мҡҙмһ„мқҙ м„ л°•л°ңмЈјм—җ м–јл§ҲлӮҳ мҳҒн–Ҙмқ„ мЈјлҠ”м§ҖлҘј 분м„қн•ҳмҳҖлӢӨ. м„ л°•нҲ¬мһҗлҠ” нҲ¬мһҗмӢңм җм—җ мӣҗк°Җк°Җ нҷ•м •лҗҳкі мҲҳмқөмқҖ н–Ҙнӣ„ мӢңнҷ©м—җ л…ём¶ңлҗҳкё° л•Ңл¬ём—җ кІҪкё°м—ӯн–үм Ғ(counter-cyclical) нҲ¬мһҗлҘј к°ҖмһҘ л°”лһҢм§Ғн•ң кІғмңјлЎң м—¬кёҙлӢӨ. к·ёлҹ¬лӮҳ нҳ„мӢӨм ҒмңјлЎң мӢңнҷ©м—җ л”°лқј нҲ¬мһҗк°Җ мқҙлЈЁм–ҙм§ҖлҠ” кІҪкё°мҲңн–үм Ғ(pro-cyclical) нҲ¬мһҗк°Җ мһҗмЈј л°ңмғқн•ңлӢӨ. лҸҷ м—°кө¬м—җм„ңлҠ” м„ л°•л°ңмЈјмҷҖ мҡҙмһ„мқҳ 충격л°ҳмқ‘н•ЁмҲҳлҘј нҶөн•ҙ кІҪкё°мҲңн–үм Ғ нҲ¬мһҗмқём§Җ кІҪкё°м—ӯн–үм Ғ нҲ¬мһҗмқём§ҖлҘј кө¬л¶„н•ҳмҳҖлӢӨ.

Apergis and Payne(2013)мқҖ BDIк°Җ кёҲмңөмһҗмӮ° л°Ҹ кұ°мӢңкІҪм ңм—җ лҢҖн•ҙ мҳҲмёЎм Ғмқё м •ліҙлҘј нҸ¬н•Ён•ҳкі мһҲлҠ”м§Җ м—¬л¶ҖлҘј нҢЁл„җ лҚ°мқҙн„°(panel data)лҘј нҶөн•ҙ 분м„қн•ҳмҳҖлӢӨ. мӣҗмһҗмһ¬мқҳ мҡҙмҶЎ 비мҡ©мқё BDIлҠ” мӮ°м—…мғқмӮ°кіј л°Җм ‘н•ң кҙҖл Ёмқҙ мһҲмңјл©°, мқҙлҠ” кі§ мӢӨл¬ј кІҪм ңнҷңлҸҷмқ„ лӮҳнғҖлӮҙлҠ” кІғмқҙлҜҖлЎң кёҲмңөмһҗмӮ° мӢңмһҘм—җлҸ„ мҳҒн–Ҙмқ„ лҜём№ңлӢӨкі кІ°лЎ мқ„ лӮҙл ёлӢӨ.

Lim and Yun(2018)мқҖ н•ҙмҡҙмӢңмһҘ м •ліҙ 분м„қм—җ мһҲм–ҙ м–ҙл–Ө ліҖмҲҳлҘј мӮ¬мҡ©н•ҳлҠ”к°Җм—җ л”°лқј лӘЁлҚёмқҳ мҳҲмёЎ кІ°кіјк°Җ нҒ¬кІҢ лӢ¬лқјм§Ҳ мҲҳ мһҲкё° л•Ңл¬ём—җ ліҖмҲҳ м„ нғқ(feature selection)мқҙ л§Өмҡ° мӨ‘мҡ”н•ҳлӢӨкі ліҙм•ҳлӢӨ. мјҖмқҙн”„м„ мӢңмһҘмҡҙмһ„мқҳ кІ°м •мҡ”мқё л°Ҹ мҡҙмһ„мҳҲмёЎ лӘЁнҳ•мқ„ 분м„қн•ҳкё° мң„н•ң ліҖмҲҳ м„ нғқмқҳ н•©лҰ¬м Ғ к·јкұ°лҘј м ңмӢңн•ҳлҠ” м—°кө¬лҘј мҲҳн–үн•ҳмҳҖлӢӨ. мҲҳмҡ”мёЎл©ҙ мҡ”мқё 5к°ңмҷҖ кіөкёүмёЎл©ҙ мҡ”мқё 11к°ңлҘј м„ м •н•ҳм—¬ лӢЁкі„м Ғ нҡҢк·Җ лӘЁнҳ•кіј лһңлҚӨ нҸ¬л ҲмҠӨнҠё лӘЁнҳ•мңјлЎң 비көҗн•ң кІ°кіј, лһңлҚӨ нҸ¬л ҲмҠӨнҠё лӘЁнҳ•мқ„ нҶөн•ҙ м„ м •н•ң кіөкёүмң„мЈјмқҳ мҡ”мқёл“Өмқҙ мҳҲмёЎкІ°кіјк°Җ лӣ°м–ҙлӮҳкё° л•Ңл¬ём—җ мјҖмқҙн”„м„ мӢңмһҘмқҳ мҳҲмёЎлӘЁлҚё ліҖмҲҳлЎң кіөкёүмёЎл©ҙ мҡ”мқёмқҙ мӨ‘мҡ”н•ҳлӢӨкі мЈјмһҘн•ҳмҳҖлӢӨ.

мөңк·јм—җлҠ” н•ҙмғҒмҡҙмһ„ мҳҲмёЎм—җ мқҙлЎ лӘЁнҳ• л°Ҹ мӢңкі„м—ҙ 분м„қ лӘЁнҳ•лҝҗ м•„лӢҲлқј мқёкіөмӢ кІҪл§қ(ANN ; artificial neural network) лӘЁнҳ•мқ„ нҷңмҡ©н•ң м—°кө¬к°Җ нҷңл°ңнһҲ 진н–үлҗҳкі мһҲлӢӨ. мқёкіөмӢ кІҪл§қ лӘЁнҳ•мқҖ нӣҲл Ё лҚ°мқҙн„°(training data)лҘј нҶөн•ҙ 충분нһҲ н•ҷмҠөн•ң нӣ„м—җ мӢӨн—ҳ лҚ°мқҙн„°(testing data)лЎң н…ҢмҠӨнҠёлҘј 진н–үн•ң лӢӨмқҢ, н•„мҡ”н•ң м§ҖмӢқмқ„ 추м¶ңн•ҙлӮҙлҠ” Knowledge Discovery кіјм •мқ„ мҲҳн–үн•ңлӢӨ.

Kim et al.(2019)лҠ” мқёкіөмӢ кІҪл§қ мӨ‘м—җм„ң LSTM(Long Short Term Memory) м•Ңкі лҰ¬мҰҳмқ„ мӮ¬мҡ©н•ҳм—¬ лІҢнҒ¬мҡҙмһ„ мҳҲмёЎмқҳ м •нҷ•лҸ„лҘј лҶ’мқҙлҠ” м—°кө¬лҘј 진н–үн•ҳмҳҖлӢӨ. мҷёл¶Җ нҷҳкІҪмҡ”мқёмңјлЎң көӯм ңмң к°Җ, лҜёкөӯ лӢӨмҡ°мЎҙмҠӨм§ҖмҲҳ, м—”/лӢ¬лҹ¬ нҷҳмңЁ, мӨ‘көӯ GDP, м„ёкі„ GDP л“ұмқ„ мӮ¬мҡ©н•ҳм—¬ ARIMAмҷҖ к°ҷмқҖ мӢңкі„м—ҙ 분м„қкіј LSTM к°ҷмқҖ мқёкіөмӢ кІҪл§қ 분м„қмқ„ 비көҗн•ң кІ°кіј, мқёкіөмӢ кІҪл§қ 분м„қмқҙ мҳҲмёЎм„ұлҠҘм—җм„ң мҡ°мҲҳн•Ёмқ„ ліҙмҳҖлӢӨ. к·ё мқҙмң лҠ” лІҢнҒ¬м„ кіј к°ҷмқҖ л¶Җм •кё° н•ҙмҡҙмӢңмһҘмқҳ мҡҙмһ„мқҖ мҷёл¶Җ 충격м—җ лҜјк°җн•ҳкІҢ л°ҳмқ‘н•ҳлҠ” мӮ°м—…мқҙлҜҖлЎң мҷёл¶Җ нҷҳкІҪм—җ лҢҖн•ң кі л Өк°Җ м§ҖмҶҚм ҒмңјлЎң м ңмӢңлҗҳм–ҙм•ј н•ҳлӮҳ, кё°мЎҙ м—°кө¬л“ӨмқҖ мқҙлҘј 충분нһҲ кі л Өн•ҳм§Җ м•Ҡм•ҳкё° л•Ңл¬ёмқҙлқјкі л°қнҳ”лӢӨ.

лІҢнҒ¬м„ мҡҙмһ„мҳҲмёЎ лӘЁнҳ•м—җ мһҲм–ҙ кё°мЎҙм—җлҠ” лӢӨм–‘н•ң нҡҢк·ҖлӘЁлҚёмқ„ мӮ¬мҡ©н•ҳмҳҖмңјлӮҳ, н•ҙмҡҙмӮ°м—…мқҳ ліҖлҸҷм„ұ(volatile), ліөмһЎм„ұ(complex) л°Ҹ мҲңнҷҳм„ұ(cyclic)мңјлЎң мқён•ҙ м •нҷ•н•ң мҳҲмёЎмқҙ м–ҙл Өмӣ лӢӨ. мқҙлҘј к·№ліөн•ҳкё° мң„н•ҙ Akyol(2019)лҠ” лЁёмӢ лҹ¬лӢқ м•Ңкі лҰ¬мҰҳ Gardien Boosted Tree(GBT)мҷҖ Multi-Layer Perceptron (MLP) learning algorithmмқ„ мӮ¬мҡ©н•ҳмҳҖлӢӨ. 2009.03вҲј2018.01 кё°к°„мқҳ WTIмҷҖ BDI, BCI, BPI, BSI(Baltic Supramax Index) мЈјк°„ лҚ°мқҙн„°лҘј мӮ¬мҡ©н•ҳм—¬ 분м„қн•ң кІ°кіј, BDI, BCI л°Ҹ мӣҗмң к°ҖкІ©мқҖ MLP лӘЁлҚёмқҙ мҳҲмёЎл Ҙмқҙ лҶ’кі BPIмҷҖ BSIлҠ” GBT лӘЁлҚёмқҙ мҳҲмёЎл Ҙмқҙ лҶ’лӢӨкі л°қнҳ”лӢӨ.

Munim and Schramm(2021)мқҳ м—°кө¬м—җм„ңлҠ” мҡҙмһ„ мҳҲмёЎм—җ м „нҶөм ҒмңјлЎң мӮ¬мҡ©лҗҳлҠ” лӘЁлҚёмқё ARIMA(Autoregressive Integrated Moving Average), VAR, VECM л°Ҹ ANN лӘЁнҳ•мқ„ 비көҗн•ҳм—¬ м–ҙлҠҗ лӘЁлҚёмқҙ мҳҲмёЎл Ҙмқҙ лҶ’мқҖм§Җ нҢҗлі„н•ҳмҳҖлӢӨ. CCFI(China Containerized Freight Index)мқҳ 4к°ң мЈјмҡ” н•ӯлЎңлҘј 분м„қн•ң кІ°кіј, м „мІҙм ҒмңјлЎң нӣҲл Ё мғҳн”Ңм—җм„ңлҠ” VAR/VECк°Җ ARIMA/ANNліҙлӢӨ мҡ°мҲҳн–Ҳкі н…ҢмҠӨнҠё мғҳн”Ңм—җм„ңлҠ” ARIMAк°Җ VAR/ANNліҙлӢӨ мҡ°мҲҳн–ҲлӢӨ. к·ёлҹ¬лӮҳ к°ңлі„ н•ӯлЎңм—җм„ңлҠ” 2к°ңмқҳ мҳҲмҷёк°Җ л°ңмғқн–ҲлҠ”лҚ°, н•ҳлӮҳлҠ” ARIMAк°Җ лҸҷл¶Ғм•„-м§ҖмӨ‘н•ҙ н•ӯлЎңм—җм„ң мҡ°мҲҳн–Ҳкі , лӢӨлҘё н•ҳлӮҳлҠ” VECMмқҙ лҸҷл¶Ғм•„-лҜёлҸҷл¶Җм—°м•Ҳ н•ӯлЎңм—җм„ң мҡ°мҲҳн–ҲлӢӨ. кІ°лЎ м ҒмңјлЎң мЈјмҡ” н•ӯлЎңм—җ лҢҖн•ң м»Ён…Ңмқҙл„Ҳ мҡҙмһ„ мҳҲмёЎм—җлҠ” ARIMAлҘј мӮ¬мҡ©н•ҳкі мҳҲмҷём ҒмңјлЎң лҸҷл¶Ғм•„-лҜёлҸҷл¶Җм—°м•Ҳ н•ӯлЎңлҠ” VECM мӮ¬мҡ©мқ„ 추мІңн•ҳмҳҖлӢӨ.

ліё м—°кө¬м—җм„ңлҠ” мӣҗмң к°ҖкІ©мқҙ лІҢнҒ¬м„ мҡҙмһ„м§ҖмҲҳм—җ м–ҙл–»кІҢ мҳҒн–Ҙмқ„ лҜём№ҳлҠ”м§Җм—җ лҢҖн•ҙ мӮҙнҺҙліҙлҠ” кІғмқҙ к·ё лӘ©м ҒмқҙлӢӨ. л”°лқјм„ң лӢӨм–‘н•ң ліҖмҲҳмқҳ кҙҖкі„м„ұмқ„ нҢҢм•…н•ҳкё°м—җ ліҙлӢӨ мҡ©мқҙн•ң мқёкіөмӢ кіөл§қ лӘЁнҳ•, лӢЁліҖлҹү 분м„қмқ„ мң„н•ҙ м Ғмҡ©лҗҳлҠ” ARIMAлӘЁнҳ• ліҙлӢӨлҠ” к°Ғ ліҖмҲҳл“Өк°„мқҳ мқёкіјм„ұмқ„ кІҖмҰқн•ҳлҠ” лӘЁнҳ•мқҙ м Ғм Ҳн• кІғмңјлЎң нҢҗлӢЁлҗңлӢӨ. м„ н–үм—°кө¬л“Өм—җ мқҳн•ҳл©ҙ ліҖмҲҳл“Ө мӮ¬мқҙмқҳ кіөм Ғ분 кҙҖкі„к°Җ мЎҙмһ¬н•ҳлҠ” кІҪмҡ° VECM лӘЁнҳ•мқ„ к·ёл Үм§Җ м•ҠмқҖ кІҪмҡ° VAR лӘЁнҳ•мқ„ м Ғмҡ©н•ҳм—¬ л‘җ ліҖмҲҳмқҳ кҙҖкі„лҘј нҢҢм•…н•ҳкі мһҲлӢӨ. ліё м—°кө¬м—җм„ңлҠ” ліҖмҲҳл“Ө к°„мқҳ кіөм Ғ분 кҙҖкі„к°Җ нҠ№лі„нһҲ нҢҢм•…лҗҳм§Җ м•Ҡм•„ VAR лӘЁнҳ•мқ„ м Ғмҡ©н•ҳм—¬ мӢӨмҰқ분м„қмқ„ мҲҳн–үн•ҙ ліҙкі мһҗ н•ңлӢӨ.

ліё м—°кө¬м—җм„ңлҠ” 2008л…„ 10мӣ”л¶Җн„° 2022л…„ 2мӣ”к№Ңм§Җмқҳ мӣ”к°„ мһҗлЈҢлҘј мқҙмҡ©н•ҳм—¬ мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ мғҒкҙҖкҙҖкі„лҘј 분м„қн•ҙ ліҙкі мһҗ н•ңлӢӨ. мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„мқҳ мғҒкҙҖм„ұмқ„ м—°кө¬н•ң м„ н–үм—°кө¬лҘј мӮҙнҺҙліҙл©ҙ л‘җл°”мқҙ мң к°Җ л“ұ н•ҳлӮҳмқҳ мң к°Җ ліҖмҲҳлҘј лҢҖмғҒмңјлЎң 분м„қ(Chung and Kim, 2011)н•ҳкұ°лӮҳ, н•ҙмҡҙмӮ¬ кІҪмҳҒм—җ м§Ғм ‘м Ғмқё мҳҒн–Ҙмқ„ лҜём№ҳлҠ” лІҷм»Өк°ҖкІ©мқ„ мӮ¬мҡ©н•ҳм—¬ 분м„қ(Kim and Chang, 2013) н•ҳмҳҖлӢӨ. ліё м—°кө¬м—җм„ңлҠ” мң к°ҖлҠ” н•ҙмҡҙмӮ¬ кІҪмҳҒм—җ м§Ғм ‘ мҳҒн–Ҙмқ„ мЈјлҠ” кІғмқҖ л¬јлЎ кёҖлЎңлІҢ кұ°мӢңкІҪм ң м „л°ҳм—җ нҒ° мҳҒн–Ҙмқ„ лҜём№ҳкё° л•Ңл¬ём—җ мӣҗмң к°ҖкІ©лҘј м„ӨлӘ…ліҖмҲҳлЎң мӮ¬мҡ©н•ҳлҠ” кІғмқҙ л„“мқҖ н•ЁмқҳлҘј к°–лҠ”лӢӨкі ліҙм•„, 3лҢҖ мӣҗмң к°ҖкІ©мқё лёҢл ҢнҠёмң , л‘җл°”мқҙмң л°Ҹ м„ңл¶Җн…ҚмӮ¬мҠӨ мӨ‘м§Ҳмң (WTI)лҘј лӘЁл‘җ 분м„қлҢҖмғҒмңјлЎң н•ҳмҳҖлӢӨ. мң к°ҖлҠ” л‘җл°”мқҙмң (DUBAI), лёҢлһңнҠёмң (BRENT), м„ңл¶Җн…ҚмӮ¬мҠӨмң (WTI)мқҳ мӣ”к°„ нҳ„л¬јк°ҖкІ©мқ„ мқҙмҡ©н•ҳмҳҖкі . лІҢнҒ¬м„ мҡҙмһ„мқҖ BDI, BCI, BPIмқҳ 3к°ң лІҢнҒ¬м„ мҡҙмһ„м§ҖмҲҳлҘј мӮ¬мҡ©н•ҳмҳҖлӢӨ.

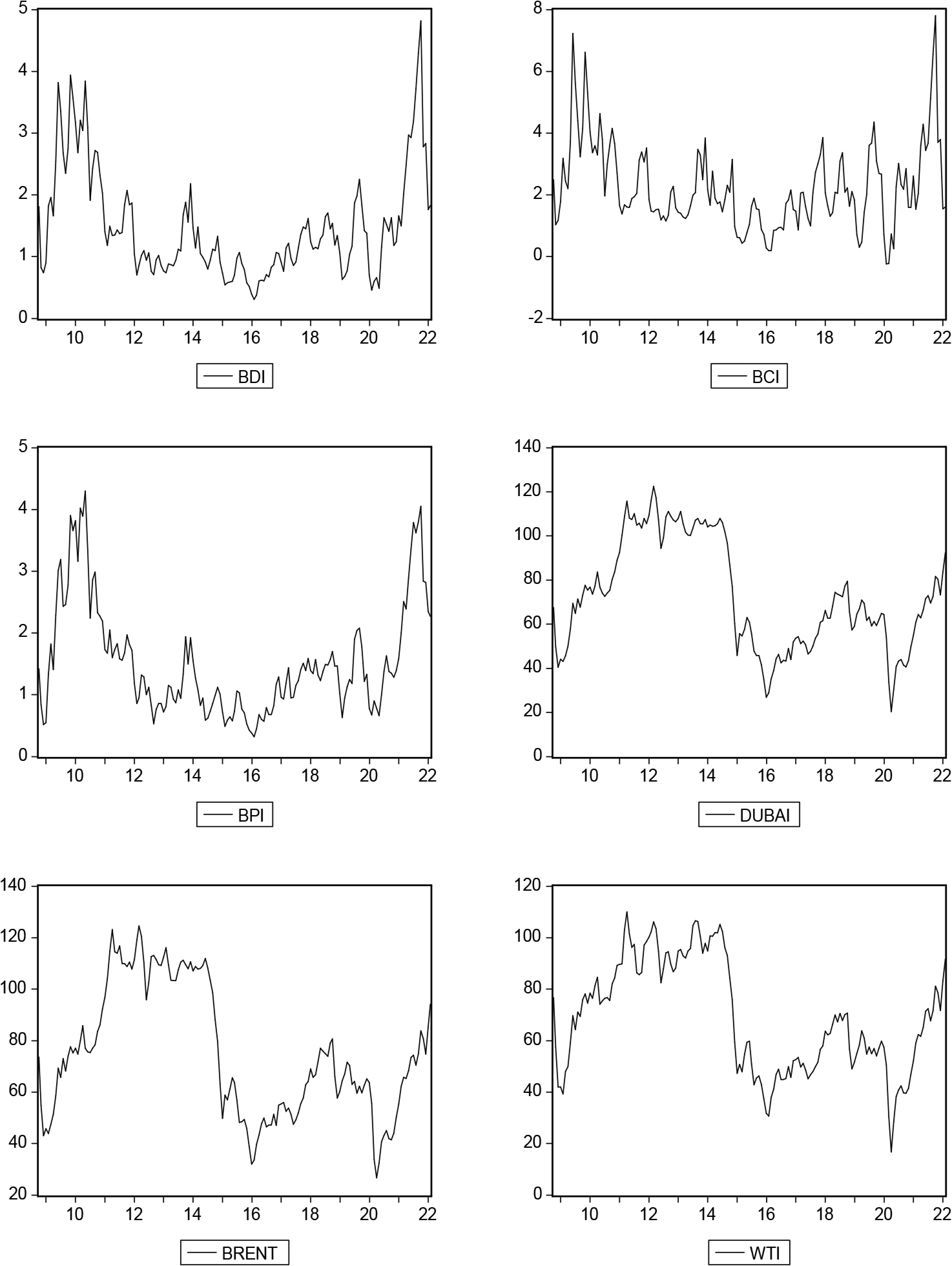

Figure 1м—җм„ңлҠ” 분м„қкё°к°„ лҸҷм•Ҳмқҳ мЈјмҡ” ліҖмҲҳ мӢңкі„м—ҙлҸ„н‘ңк°Җ м ңмӢңлҗҳкі мһҲлӢӨ.

Table 1мқ„ мӮҙнҺҙліҙл©ҙ мң к°Җ ліҖнҷ”мңЁкіј лІҢнҒ¬м„ мҡҙмһ„ м§ҖмҲҳ ліҖнҷ”мңЁмқҳ нҸүк· мқҖ мң мӮ¬н•ҳм§Җл§Ң н‘ңмӨҖнҺём°ЁлҠ” лІҢнҒ¬м„ мҡҙмһ„ м§ҖмҲҳл“Өмқҙ мң к°Җ ліҖнҷ”мңЁліҙлӢӨ мғҒлҢҖм ҒмңјлЎң лҶ’мқҖ кІғмңјлЎң лӮҳнғҖлӮ¬лӢӨ. мқҙлҠ” лІҢнҒ¬м„ мҡҙмһ„м§ҖмҲҳмқҳ кІҪмҡ° м„ л°• 비мӨ‘кіј м„ нҳ•лі„ л¬јлҸҷлҹүм—җ м°Ёмқҙк°Җ мһҲкё° л•Ңл¬ёмңјлЎң мғқк°ҒлҗңлӢӨ. J-B кІҖм •, мҷңлҸ„, мІЁлҸ„ к°’лҘј м°ёкі н•ҳл©ҙ, лӘЁл“ ліҖмҲҳл“Өмқҳ 분нҸ¬к°Җ м •к·ң분нҸ¬м—җ к·јмӮ¬н•ҳм§Җ м•ҠмқҖ кІғмңјлЎң лӮҳнғҖлӮ¬лӢӨ.

ліё м—°кө¬лҠ” мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ кҙҖкі„лҘј м¶”м •н•ҳлҠ”лҚ° мһҲм–ҙ мӢңкі„м—ҙ ліҖмҲҳл“Ө к°„мқҳ мқёкіјм„ұ кІҖмҰқмқ„ мң„н•ң VAR лӘЁнҳ•мқ„ нҷңмҡ©н•ҳмҳҖлӢӨ. мқҙлҘј мң„н•ҙ ADF лӢЁмң„к·ј кІҖм •, к·ёлһңм Җ мқёкіјкҙҖкі„(Granger casuality) кІҖм •, 충격л°ҳмқ‘н•ЁмҲҳ кІҖм •, мҳҲмёЎмҳӨм°Ё 분мӮ°л¶„н•ҙ кІҖм •мқ„ мҲҳн–үн•ҳм—¬ мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ мғҒкҙҖкҙҖкі„лҘј 분м„қн•ҳмҳҖлӢӨ.

м—¬кё°м—җм„ңлҠ” л‘җ ліҖмҲҳ к°„мқҳ мқёкіјм„ұ кІҖм •мқ„ мң„н•ң к·ёлһңм Җ мқёкіјкҙҖкі„(Granger casuality) кІҖм •м—җ лҢҖн•ҙ к°„лӢЁнһҲ мӮҙнҺҙліҙкі мһҗ н•ңлӢӨ. лӢӨмқҢкіј к°ҷмқҖ л‘җ ліҖмҲҳмқҳ кіјм •мқ„ pм°Ё лІЎн„°мһҗкё°нҡҢк·Җкіјм •(VAR(p)кіјм •) мқҙлқјкі н•ҳл©° лӢӨмқҢкіј к°ҷмқҙ н‘ңнҳ„н•ңлӢӨ.

м—¬кё°м—җм„ң Yt, d, ОҰj, ПөtлҠ” к°Ғк°Ғ лӢӨмқҢкіј к°ҷмқҙ м •мқҳлҗҳл©°,

Пөt=(Пөt1, Пө't2)'лҠ” м„ңлЎң лҸ…лҰҪм Ғмқё л°ұмғүмһЎмқҢмқҙлӢӨ.

мӢңкі„м—ҙ {Yt2}мқҳ кіјкұ°мҷҖ нҳ„мһ¬мқҳ м •ліҙк°Җ мӢңкі„м—ҙ {Yt1}мқҳ лҜёлһҳк°’мқ„ мҳҲмёЎн•ҳлҠ”лҚ° лҸ„мӣҖмқҙ лҗҳл©ҙ {Yt2}лҠ” {Yt1}мқҳ Granger- cause н•ңлӢӨкі н•ңлӢӨ. мҰү, VAR(p)м—җм„ң Granger casuality кІҖм •мқҖ лӢӨмқҢмқҳ л‘җ к·Җл¬ҙк°Җм„Өмқ„ к°Ғк°Ғ кІҖм •н•ҳлҠ” кІғмқҙл©°,

F-кІҖм •, ПҮ2кІҖм •, LR-кІҖм •, Wald-кІҖм •, LM-кІҖм • л“ұ м—¬лҹ¬ к°Җм§Җ л°©лІ•мңјлЎң мӢӨн–ү к°ҖлҠҘн•ҳлӢӨ.

ліё м—°кө¬м—җ нҲ¬мһ…н• ліҖмҲҳл“Өм—җ лҢҖн•ҙм„ң м •мғҒм„ұ(stationality)мқ„ нҢҗлі„н•ҳлҠ” лӢЁмң„к·ј кІҖм •мқ„ мӢӨмӢңн•ҳм—¬ лӢЁмң„к·ј мЎҙмһ¬ м—¬л¶ҖлҘј кІҖм •н•ҳкі , лӢЁмң„к·јмқҙ мЎҙмһ¬н• кІҪмҡ°м—җ 차분(differentiation) л“ұ ліҖмҲҳліҖнҷҳмқ„ нҶөн•ҙ ліҖмҲҳл“Өмқ„ м•Ҳм •нҷ”н•ҙм•ј н•ңлӢӨ. ліё м—°кө¬м—җм„ңлҠ” лӢЁмң„к·ј кІҖм •мқ„ мң„н•ҙ Augmented Dickey Fuller (ADF) лӢЁмң„к·ј кІҖм •мқ„ мҲҳн–үн•ҳмҳҖлӢӨ. 5% мң мқҳмҲҳмӨҖм—җм„ң ADF лӢЁмң„к·ј кІҖм •кІ°кіјлҘј ліҙл©ҙ LBPI, LDUBAI, LBRENT, LWTI л“ұмқҳ мҲҳмӨҖліҖмҲҳл“ӨмқҖ л¶Ҳм•Ҳм •м Ғ мӢңкі„м—ҙмқё кІғмңјлЎң лӮҳнғҖлӮ¬лӢӨ. мқҙм—җ 1м°Ё 차분 нӣ„ ліҖмҲҳмқҳ кІҪмҡ° м•Ҳм • мӢңкі„м—ҙмқҙ лҗҳм–ҙ, ліё м—°кө¬м—җм„ңлҠ” мӢңкі„м—ҙ к°„мқҳ мқёкіјм„ұ кІҖм •мқ„ мң„н•ҙ 1м°Ё 차분н•ң к°’мқ„ ліҖмҲҳлЎң мӮ¬мҡ©н•ҳмҳҖлӢӨ.

мқёкіјм„ұ(Granger casuality) кІҖм •мқҖ мӣҗмқёкіј кІ°кіјлҘј нҠ№м •н•ҳм§Җ м•Ҡкі л‘җ мӢңкі„м—ҙ ліҖмҲҳ к°„мқҳ кҙҖкі„м„ұ мң л¬ҙлҘј кІҖмҰқн•ҳлҠ” л°©лІ•мқҙлӢӨ. н•ҳм§Җл§Ң ліё м—°кө¬м—җм„ңлҠ” лІҢнҒ¬м„ мҡҙмһ„мқ„ кІ°кіј ліҖмҲҳлЎң н•ҳкі м„ӨлӘ…ліҖмҲҳмқё мң к°Җк°Җ мҡҙмһ„м—җ мӢӨм ң мҳҒн–Ҙмқ„ лҜём№ҳкі мһҲлҠ”м§Җ мӮҙнҺҙліҙкі мһҗ н•ҳмҳҖлӢӨ. мқҙм—җ мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ мғҒкҙҖкҙҖкі„лҘј 분м„қн•ҳкё° мң„н•ҙ мқёкіјкҙҖкі„(Granger casuality) 분м„қмқ„ мҲҳн–үн•ҳмҳҖлӢӨ. мң к°Җм—җлҠ” л‘җл°”мқҙмң , лёҢлһңнҠёмң , WTIмң лҘј л‘җкі , лІҢнҒ¬м„ мҡҙмһ„мңјлЎңлҠ” BDI, BCI, BPI ліҖмҲҳл“Өмқ„ м„ м •н•ҳм—¬ VAR лӘЁнҳ•мқ„ м Ғн•©н•ҳмҳҖлӢӨ. к·ё кІ°кіјлҠ” Table 3м—җ м ңмӢңлҗҳм–ҙ мһҲлӢӨ. ліё м—°кө¬мқҳ мқёкіјм„ұ кІҖм •мқ„ мҲҳн–үн•ң кІ°кіј, мң мқҳмҲҳмӨҖ 5%м—җм„ң мң к°Җ кҙҖл Ё лӘЁл“ ліҖмҲҳк°Җ лІҢнҒ¬м„ мҡҙмһ„(BDI, BCI, BPI)м—җ лҢҖн•ҙм„ң лӘЁл‘җ мқёкіјкҙҖкі„к°Җ мЎҙмһ¬н•ҳлҠ” кІғмңјлЎң м¶”м •лҗҳм—ҲлӢӨ.

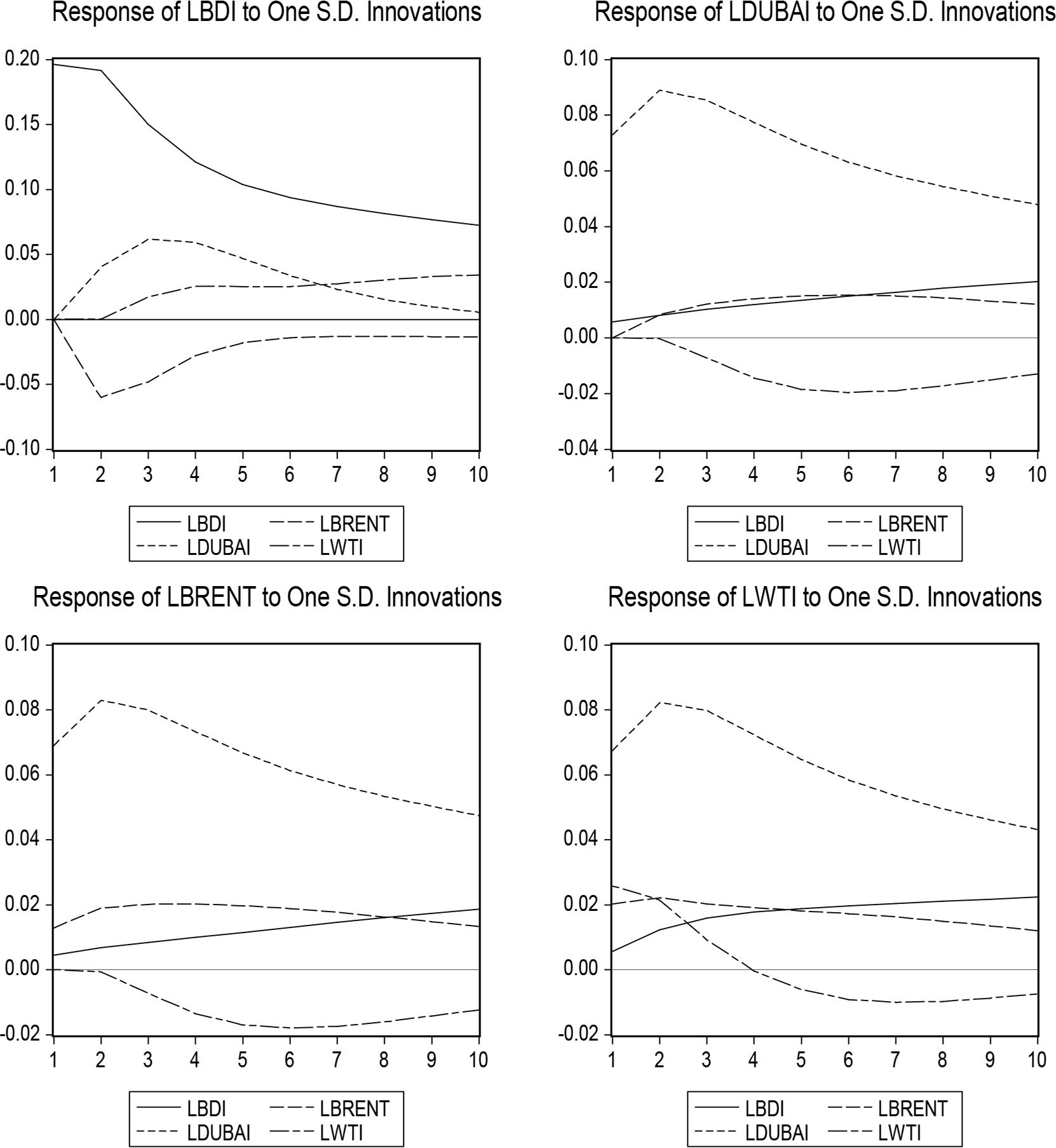

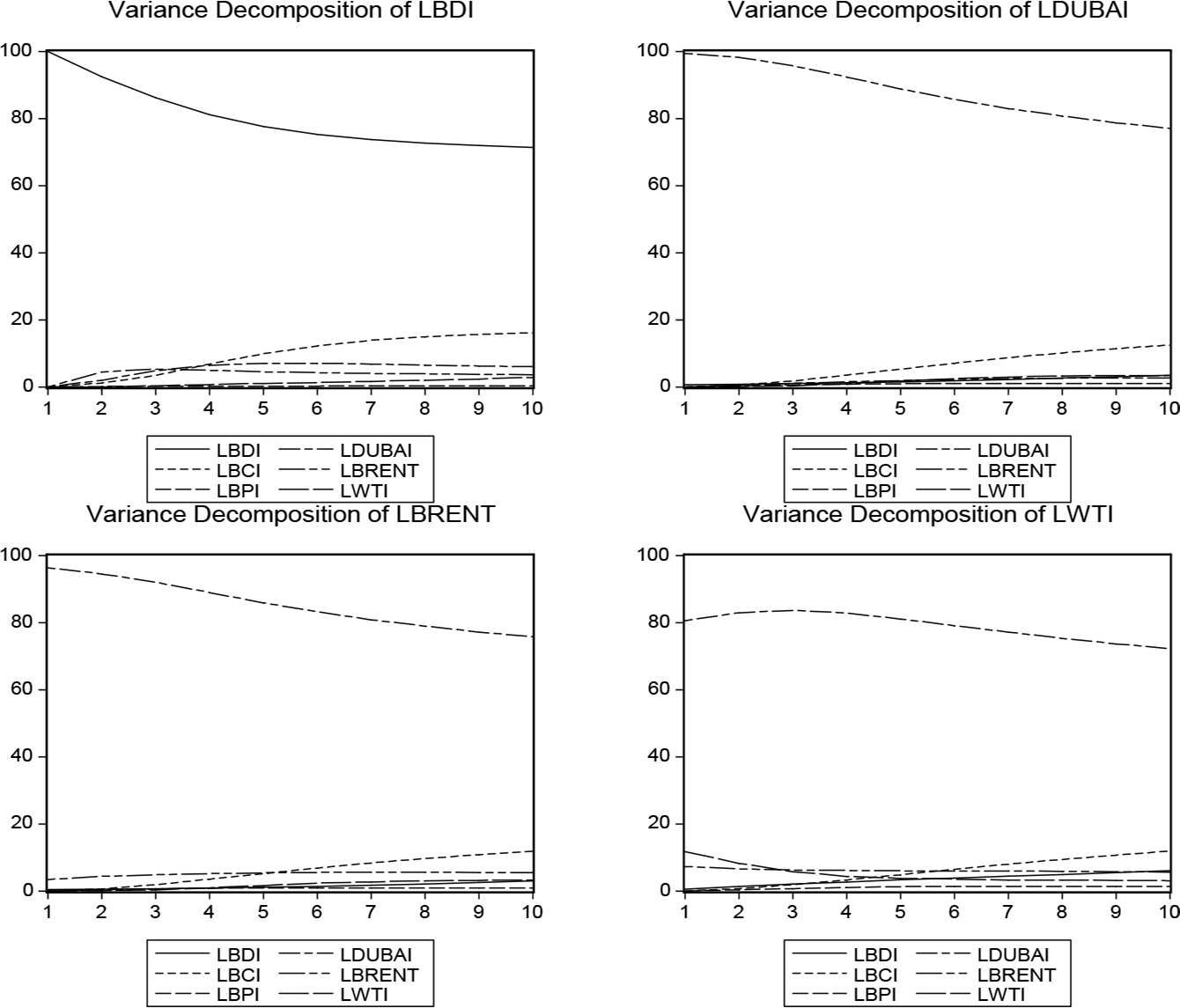

мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„ 충격л°ҳмқ‘ 분м„қкІ°кіјлҠ” лӢӨмқҢкіј к°ҷлӢӨ.

LBDIм—җ лҢҖн•ң мӢңм°Ё 1л¶Җн„° мӢңм°Ё 10к№Ңм§Җ лӢЁмң„лӢ№ 충격м—җ л”°лҘё л°ҳмқ‘мқ„ ліҙл©ҙ, л‘җл°”мқҙмң (LDUBAI)лҠ” мӢңм°Ё 1м—җ 0.57%лЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 1.34%лЎң мҰқк°Җн•ҳлӢӨк°Җ, мӢңм°Ё 10м—җ 2.02%к№Ңм§Җ м§ҖмҶҚм ҒмңјлЎң мҰқк°ҖмҳҖлӢӨ. лёҢлһңнҠёмң (LBRENT)лҠ” мӢңм°Ё 1м—җ 0.44%лЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 1.14%лЎң мҰқк°Җн•ҳлӢӨк°Җ, мӢңм°Ё 10м—җ 1.85%к№Ңм§Җ м§ҖмҶҚм ҒмңјлЎң мҰқк°ҖмҳҖлӢӨ. м„ңл¶Җн…ҚмӮ¬мҠӨмң (LWTI)лҠ” мӢңм°Ё 1м—җ 0.57%лЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 1.88%лЎң мҰқк°Җн•ҳлӢӨк°Җ, мӢңм°Ё 10м—җ 2.23%к№Ңм§Җ м§ҖмҶҚм ҒмңјлЎң мҰқк°ҖмҳҖлӢӨ.

LBCIм—җ лҢҖн•ң мӢңм°Ё 1л¶Җн„° мӢңм°Ё 10к№Ңм§Җ лӢЁмң„лӢ№ 충격м—җ л”°лҘё л°ҳмқ‘мқ„ ліҙл©ҙ, л‘җл°”мқҙмң (LDUBAI)лҠ” мӢңм°Ё 1м—җ 0.91%лЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 0.03%лЎң к°җмҶҢн•ҳлӢӨк°Җ, мӢңм°Ё 10м—җ 0.24%к№Ңм§Җ лӢӨмӢң мҰқк°ҖмҳҖлӢӨ. лёҢлһңнҠёмң (LBRENT)лҠ” мӢңм°Ё 1м—җ 0.68%лЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ -0.10%лЎң к°җмҶҢн•ҳлӢӨк°Җ, мӢңм°Ё 10м—җ 0.18%лЎң лӢӨмӢң мҰқк°ҖмҳҖлӢӨ. м„ңл¶Җн…ҚмӮ¬мҠӨмң (LWTI)лҠ” мӢңм°Ё 1м—җ 0.51%лЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 0.48%лЎң к°җмҶҢн•ҳлӢӨк°Җ, мӢңм°Ё 10м—җ 0.45%лЎң к°җмҶҢмҳҖлӢӨ.

LBPIм—җ лҢҖн•ң мӢңм°Ё 1л¶Җн„° мӢңм°Ё 10к№Ңм§Җ лӢЁмң„лӢ№ 충격м—җ л”°лҘё л°ҳмқ‘мқ„ ліҙл©ҙ, л‘җл°”мқҙмң (LDUBAI) мӢңм°Ё 1м—җ 0.59%лЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 4.04%лЎң мҰқк°Җн•ҳлӢӨк°Җ, мӢңм°Ё 10м—җ 4.24%к№Ңм§Җ м§ҖмҶҚм ҒмңјлЎң мҰқк°ҖмҳҖлӢӨ. лёҢлһңнҠёмң (LBRENT) мӢңм°Ё 1м—җ 0.40%лЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 3.62%лЎң мҰқк°Җн•ҳлӢӨк°Җ, мӢңм°Ё 10м—җ 4.01%к№Ңм§Җ м§ҖмҶҚм ҒмңјлЎң мҰқк°ҖмҳҖлӢӨ. м„ңл¶Җн…ҚмӮ¬мҠӨмң (LWTI) мӢңм°Ё 1м—җ 0.86%лЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 4.44%лЎң мҰқк°Җн•ҳлӢӨк°Җ, мӢңм°Ё 10м—җ 4.27%к№Ңм§Җ м•Ҫк°„ к°җмҶҢмҳҖлӢӨ.

충격л°ҳмқ‘н•ЁмҲҳ кІ°кіјлҘј мӮҙнҺҙліҙл©ҙ, BDIлҠ” кұҙнҷ”л¬јмқҳ м—¬лҹ¬ м„ мў…мқҳ мҡҙмһ„м—җ лҢҖн•ң мў…н•©м§ҖмҲҳмқҳ м„ұкІ©мқ„ к°–лҠ” л°ҳл©ҙ, BCIмҷҖ BPIлҠ” м„ мў…лі„ мҡҙмһ„мңјлЎң мҡҙмҶЎнҷ”л¬ј л°Ҹ мҡҙмҶЎкұ°лҰ¬ л“ұм—җм„ң м°ЁмқҙлҘј ліҙмқёлӢӨ. мқҙм—җ л”°лқј мҡҙмһ„мқҳ ліҖлҸҷм„ұм—җм„ңлҸ„ м°ЁмқҙлҘј ліҙмқҙкё° л•Ңл¬ём—җ 충격л°ҳмқ‘н•ЁмҲҳмқҳ кІ°кіјк°Җ м°ЁмқҙлҘј ліҙмқҙлҠ” кІғмңјлЎң м¶”м •лҗңлӢӨ.

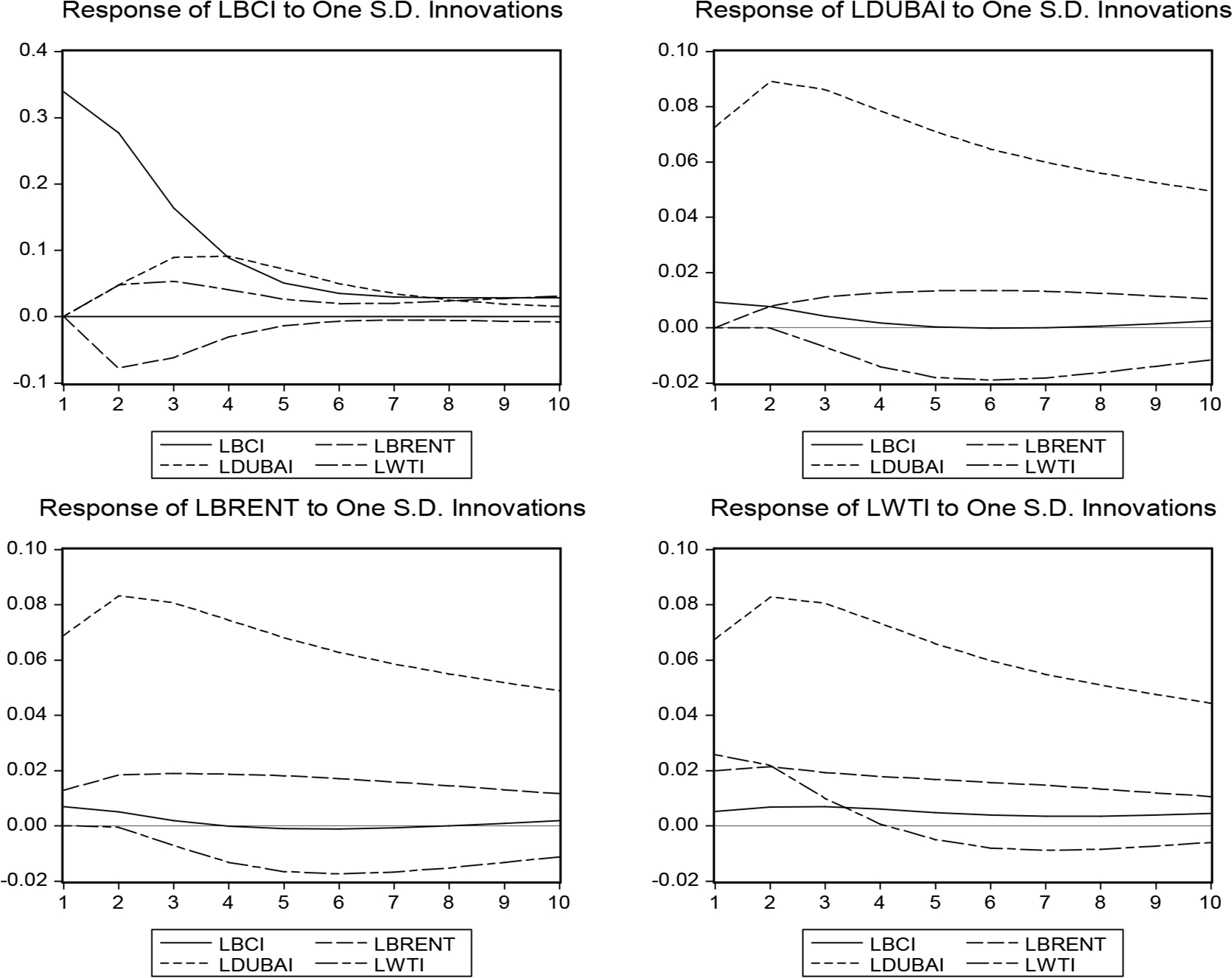

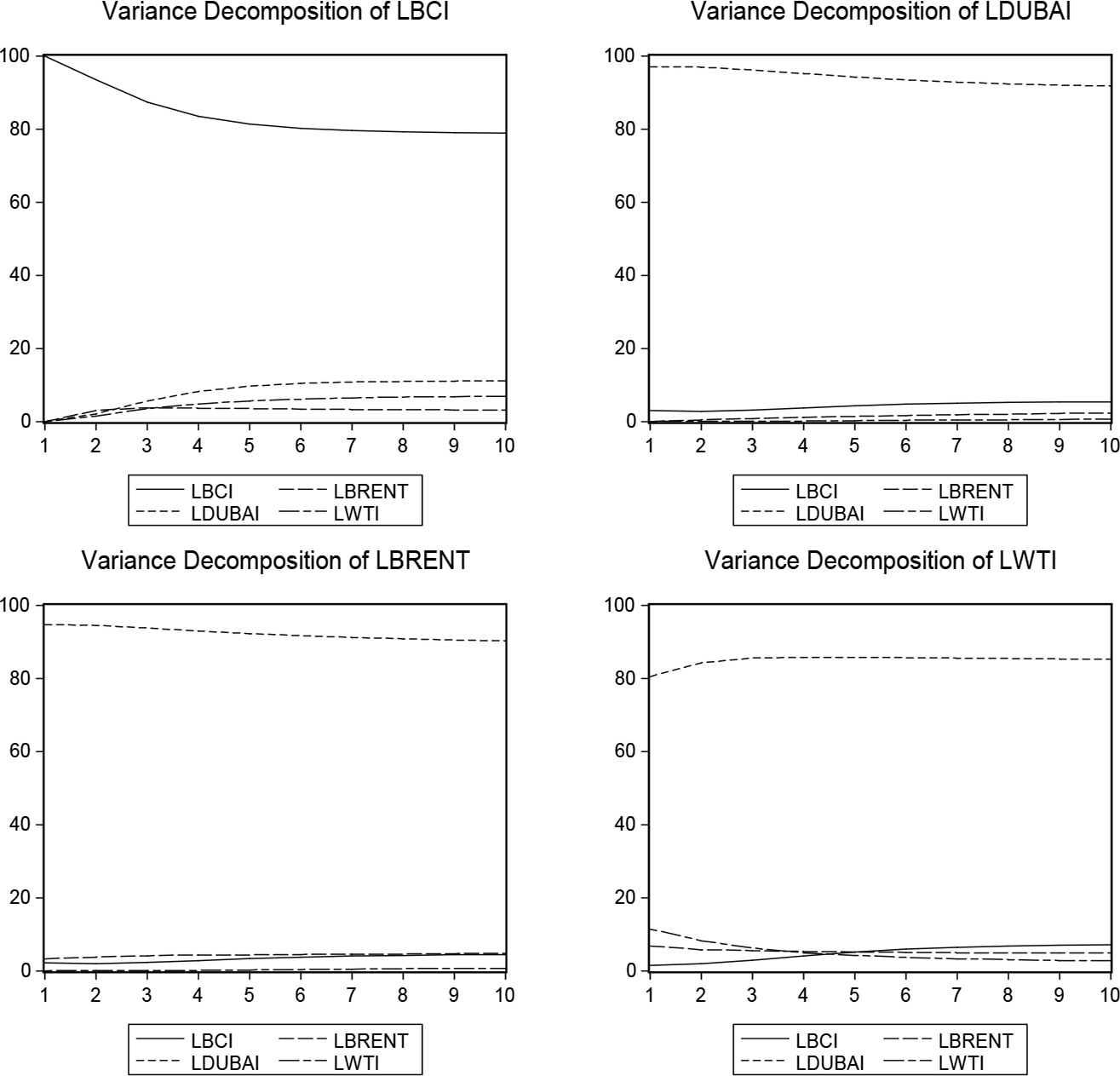

мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ мҳҲмёЎмҳӨм°Ё 분мӮ°л¶„н•ҙ 분м„қкІ°кіјлҠ” лӢӨмқҢкіј к°ҷлӢӨ.

LBDIм—җ лҢҖн•ң мӢңм°Ё 1л¶Җн„° мӢңм°Ё 10к№Ңм§Җ лӢЁмң„лӢ№ 충격м—җ л”°лҘё л°ҳмқ‘мқ„ ліҙл©ҙ, л‘җл°”мқҙмң (LDUBAI) мӢңм°Ё 1м—җ 0.62%мқҳ м„ӨлӘ…л ҘмңјлЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 1.50%лЎң мҰқк°Җн•ҳлӢӨк°Җ, мӢңм°Ё 10м—җ 3.50%к№Ңм§Җ м§ҖмҶҚм ҒмңјлЎң мҰқк°ҖмҳҖлӢӨ. лёҢлһңнҠёмң (LBRENT)лҠ” мӢңм°Ё 1м—җ 0.40%мқҳ м„ӨлӘ…л ҘмңјлЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 1.12%лЎң, мӢңм°Ё 10м—җ 2.94%к№Ңм§Җ м§ҖмҶҚм ҒмңјлЎң мҰқк°ҖмҳҖлӢӨ. м„ңл¶Җн…ҚмӮ¬мҠӨмң (LWTI)лҠ” мӢңм°Ё 1м—җ 0.56%мқҳ м„ӨлӘ…л ҘмңјлЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 3.29%лЎң, мӢңм°Ё 10м—җ 6.01%к№Ңм§Җ м§ҖмҶҚм ҒмңјлЎң мҰқк°ҖмҳҖлӢӨ.

LBCIм—җ лҢҖн•ң мӢңм°Ё 1л¶Җн„° мӢңм°Ё 10к№Ңм§Җ лӢЁмң„лӢ№ 충격м—җ л”°лҘё л°ҳмқ‘мқ„ ліҙл©ҙ, л‘җл°”мқҙмң (LDUBAI)лҠ” мӢңм°Ё 1м—җ 0.00%мқҳ м„ӨлӘ…л ҘмңјлЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 5.24%лЎң мҰқк°Җн•ҳлӢӨк°Җ, мӢңм°Ё 10м—җ 12.38%к№Ңм§Җ мҰқк°ҖмҳҖлӢӨ. лёҢлһңнҠёмң (LBRENT)лҠ” мӢңм°Ё 1м—җ 0.00%мқҳ м„ӨлӘ…л ҘмңјлЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 5.16%лЎң, мӢңм°Ё 10м—җ 11.80%лЎң мҰқк°ҖмҳҖлӢӨ. м„ңл¶Җн…ҚмӮ¬мҠӨмң (LWTI)лҠ” мӢңм°Ё 1м—җ 0.00%лЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 4.74%лЎң, мӢңм°Ё 10м—җ 11.79%лЎң мҰқк°ҖмҳҖлӢӨ.

LBPIм—җ лҢҖн•ң мӢңм°Ё 1л¶Җн„° мӢңм°Ё 10к№Ңм§Җ лӢЁмң„лӢ№ 충격м—җ л”°лҘё л°ҳмқ‘мқ„ ліҙл©ҙ, л‘җл°”мқҙмң (LDUBAI)лҠ” мӢңм°Ё 1м—җ 0.00%мқҳ м„ӨлӘ…л ҘмңјлЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 0.89%лЎң, мӢңм°Ё 10м—җ 0.96%к№Ңм§Җ мҰқк°ҖмҳҖлӢӨ. лёҢлһңнҠёмң (LBRENT)лҠ” мӢңм°Ё 1м—җ 0.00%мқҳ м„ӨлӘ…л ҘмңјлЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 0.86%лЎң, мӢңм°Ё 10м—җ 0.88%к№Ңм§Җ мҰқк°ҖмҳҖлӢӨ. м„ңл¶Җн…ҚмӮ¬мҠӨмң (LWTI)лҠ” мӢңм°Ё 1м—җ 0.00%мқҳ м„ӨлӘ…л ҘмңјлЎң мӢңмһ‘н•ҙм„ң мӢңм°Ё 5м—җ 1.21%лЎң, мӢңм°Ё 10м—җ 1.34%к№Ңм§Җ мҰқк°ҖмҳҖлӢӨ.

BDIлҠ” кұҙнҷ”л¬јмқҳ м—¬лҹ¬ м„ мў…мқҳ мҡҙмһ„м—җ лҢҖн•ң мў…н•©м§ҖмҲҳмқҳ м„ұкІ©мқ„ к°–лҠ” л°ҳл©ҙ, BCIмҷҖ BPIлҠ” м„ мў…лі„ мҡҙмһ„мңјлЎң мҡҙмҶЎнҷ”л¬ј л°Ҹ мҡҙмҶЎкұ°лҰ¬ л“ұм—җм„ң м°ЁмқҙлҘј ліҙмқёлӢӨ. мқҙм—җ л”°лқј мҡҙмһ„мқҳ ліҖлҸҷм„ұм—җм„ңлҸ„ м°ЁмқҙлҘј ліҙмқҙкё° л•Ңл¬ём—җ мҳҲмёЎмҳӨм°Ё 분мӮ°л¶„н•ҙ кІҖм • кІ°кіјк°Җ м°ЁмқҙлҘј ліҙмқҙлҠ” кІғмңјлЎң м¶”м •лҗңлӢӨ.

ліё м—°кө¬лҠ” мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ мғҒкҙҖкҙҖкі„лҘј 분м„қн•ҳкё° мң„н•ҳм—¬ мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ кҙҖкі„м„ұм—җ лҢҖн•ң м„ н–үм—°кө¬м—җ кё°мҙҲн•ҙм„ң м—°кө¬лҘј мҲҳн–үн•ҳмҳҖлӢӨ. к·ёлҸҷм•Ҳ мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ кҙҖл Ём„ұмқ„ 분м„қн•ң м—°кө¬лҘј ліҙл©ҙ мң к°Җ ліҖмҲҳлЎң лёҢл ҢнҠёмң , л‘җл°”мқҙмң лҳҗлҠ” м„ңл¶Җн…ҚмӮ¬мҠӨмң (WTI) мӨ‘м—җм„ң н•ҳлӮҳлҘј м„ м •н•ҳм—¬ BDI, BCI, BPI к°„мқҳ кҙҖл Ём„ұмқ„ 분м„қн•ң м—°кө¬к°Җ лҢҖл¶Җ분мқҙм—ҲлӢӨ. лҳҗн•ң лІҢнҒ¬м„ мҡҙмһ„лҸ„ BDI, BCI, BPI мҡҙмһ„м§ҖмҲҳлҘј к°ҖмһҘ л§Һмқҙ м—°кө¬лӘЁнҳ•м—җ мқҙмҡ©н•ҳмҳҖкі , мқҙ мҷём—җлҸ„ BSI, BHI мҡҙмһ„м§ҖмҲҳлҘј мӢӨмҰқм—°кө¬м—җ мқҙмҡ©н•ҳмҳҖлӢӨ. ліё м—°кө¬мқҳ кё°мЎҙм—°кө¬л“Өкіј м°Ёмқҙм җмқҖ мң к°ҖлҘј л‘җл°”мқҙмң (DUBAI), лёҢлһңнҠёмң (BRENT), м„ңл¶Җн…ҚмӮ¬мҠӨмң (WTI)мқҳ 3к°ң ліҖмҲҳлҘј лӘЁл‘җ мқҙмҡ©н•ҳм—¬ BDI, BCI, BPI к°„мқҳ кҙҖл Ём„ұмқ„ м¶”м •н•ҳмҳҖлӢӨлҠ” м җмқҙлӢӨ. мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ мғҒкҙҖкҙҖкі„лҘј VAR 분м„қмңјлЎң м¶”м •н•ң нӣ„, 충격л°ҳмқ‘н•ЁмҲҳмҷҖ мҳҲмёЎмҳӨм°Ё 분мӮ°л¶„н•ҙ кІҖм •мқ„ мҲҳн–үн•ң кІ°кіјлҠ” лӢӨмқҢкіј к°ҷлӢӨ.

мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ 충격л°ҳмқ‘ 분м„қкІ°кіјлҘј ліҙл©ҙ, мқҙлҠ” 2008л…„ 10мӣ”л¶Җн„° 2022л…„ 2мӣ”к№Ңм§Җ кё°к°„ лҸҷм•Ҳ LBDIм—җ лҢҖн•ҙм„ң м„ңл¶Җн…ҚмӮ¬мҠӨмң (LWTI)лҠ” 0.57%пҪһ2.53%лЎң к°ҖмһҘ нҒ° мҳҒн–Ҙмқ„ лҜёміӨмңјл©°, к·ё лӢӨмқҢмңјлЎң л‘җл°”мқҙмң (LDUBAI) 0.57%пҪһ2.02%, лёҢлһңнҠёмң (LBRENT) 0.44%пҪһ1.85%мҲңмңјлЎң м°ЁмқҙлҘј ліҙмҳҖлӢӨ. LBCIм—җ лҢҖн•ҙм„ң л‘җл°”мқҙмң (LDUBAI) 0.03%пҪһ0.91%лЎң к°ҖмһҘ нҒ° мҳҒн–Ҙмқ„ лҜёміӨмңјл©°, к·ё лӢӨмқҢмңјлЎң лёҢлһңнҠёмң (LBRENT) -0.10%пҪһ0.68%, м„ңл¶Җн…ҚмӮ¬мҠӨмң (LWTI)лҠ” 0.45%пҪһ0.51% мҲңмңјлЎң м°ЁмқҙлҘј ліҙмҳҖлӢӨ.

LBPIм—җ лҢҖн•ҙм„ң м„ңл¶Җн…ҚмӮ¬мҠӨмң (LWTI)лҠ” 0.86%пҪһ4.44%лЎң к°ҖмһҘ нҒ° мҳҒн–Ҙмқ„ лҜёміӨмңјл©°, к·ё лӢӨмқҢмңјлЎң л‘җл°”мқҙмң (LDUBAI) 0.59%пҪһ4.24%, лёҢлһңнҠёмң (LBRENT) 0.40%пҪһ4.01%мҲңмңјлЎң м°ЁмқҙлҘј ліҙмҳҖлӢӨ.

мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ мҳҲмёЎмҳӨм°Ё 분мӮ°л¶„н•ҙ 분м„қкІ°кіјлҘј ліҙл©ҙ, мқҙлҠ” 2008л…„ 10мӣ”л¶Җн„° 2022л…„ 2мӣ”к№Ңм§Җ кё°к°„ лҸҷм•Ҳ LBDIм—җ лҢҖн•ҙм„ң м„ңл¶Җн…ҚмӮ¬мҠӨмң (LWTI)лҠ” 0.56%пҪһ6.01%лЎң к°ҖмһҘ нҒ° м„ӨлӘ…л Ҙмқ„ ліҙмҳҖмңјл©°, к·ё лӢӨмқҢмңјлЎң л‘җл°”мқҙмң (LDUBAI) 0.62%пҪһ3.50%, лёҢлһңнҠёмң (LBRENT) 0.40%пҪһ2.94%мҲңмңјлЎң м°ЁмқҙлҘј ліҙмҳҖлӢӨ. LBCIм—җ лҢҖн•ҙм„ң л‘җл°”мқҙмң (LDUBAI) 0.00%пҪһ12.38%лЎң к°ҖмһҘ нҒ° м„ӨлӘ…л Ҙмқ„ ліҙмҳҖмңјл©°, к·ё лӢӨмқҢмңјлЎң м„ңл¶Җн…ҚмӮ¬мҠӨмң (LWTI)лҠ” 0.00%пҪһ11.79%, лёҢлһңнҠёмң (LBRENT) 0.00%пҪһ11.38% мҲңмңјлЎң м°ЁмқҙлҘј ліҙмҳҖлӢӨ. LBPIм—җ лҢҖн•ҙм„ң м„ңл¶Җн…ҚмӮ¬мҠӨмң (LWTI)лҠ” 0.00%пҪһ1.34%лЎң к°ҖмһҘ нҒ° м„ӨлӘ…л Ҙмқ„ ліҙмҳҖмңјл©°, к·ё лӢӨмқҢ л‘җл°”мқҙмң (LDUBAI) 0.00%пҪһ0.96%, лёҢлһңнҠёмң (LBRENT) 0.00%пҪһ0.88% мҲңмңјлЎң м°ЁмқҙлҘј ліҙмҳҖлӢӨ.

3лҢҖ көӯм ң мӣҗмң к°ҖкІ©мқё WTI, Brent, Dubaiмқҳ к°ҖкІ©мқҖ мһҘкё°м ҒмңјлЎң к°ҷмқҖ л°©н–ҘмңјлЎң мӣҖм§Ғмқҙм§Җл§Ң, лӢЁкё°м Ғмқё мҲҳкёү, м „мІҙ кұ°лһҳл¬јлҸҷлҹү л°Ҹ м„ л¬јВ·мҳөм…ҳкұ°лһҳлҹү л“ұм—җ мқҳн•ҙ л¶Җ분м ҒмңјлЎң ліҖлҸҷнҸӯм—җ м°ЁмқҙлҘј ліҙмқёлӢӨ. WTIлҠ” к°ҖмһҘ нҷңл°ңн•ҳкІҢ кұ°лһҳлҗҳкё° л•Ңл¬ём—җ лІҢнҒ¬м„ мҡҙмһ„кіјмқҳ кҙҖкі„м—җм„ң к°ҖмһҘ м„ӨлӘ…л Ҙмқҙ лҶ’мқҖ кІғмңјлЎң м¶”м •лҗңлӢӨ.

ліё м—°кө¬лҘј нҶөн•ҙм„ң мң к°ҖлҠ” м—¬м „нһҲ лІҢнҒ¬м„ мҡҙмһ„м—җ мғҒлӢ№н•ң мҳҒн–Ҙмқ„ лҜём№ҳкі мһҲмқҢмқ„ м•Ң мҲҳ мһҲлӢӨ. IMO 2020м—җ л”°лқј нғ„мҶҢл°°м¶ң к°җ축мқ„ мң„н•ҙ м„қмң м—җ кё°л°ҳн•ң м—°лЈҢмң мӮ¬мҡ©мқ„ м җ진м ҒмңјлЎң мӨ„м—¬ к¶Ғк·№м ҒмңјлЎң м„қмң лҘј л°°м ңн•ң мҷ„м „н•ң м№ңнҷҳкІҪ м—°лЈҢ м„ л°•мңјлЎң м „нҷҳн•ҳлҠ” кіјм •м—җ мһҲмқҢм—җлҸ„ л¶Ҳкө¬н•ҳкі , мң к°ҖлҠ” м—¬м „нһҲ н•ҙмҡҙм—…м—җ нҒ° мҳҒн–Ҙмқ„ лҜём№ҳкі мһҲлӢӨ. мҡҙмһ„мқҖ н•ҙмҡҙм—… кІҪмҳҒм„ұкіјм—җ кІ°м •м Ғмқё мҳҒн–Ҙмқ„ лҜём№ҳлҠ” мҡ”мқёмқҙкё° л•Ңл¬ём—җ мҡҙмһ„м—җ мҳҒн–Ҙмқ„ мЈјлҠ” ліҖмҲҳм—җ лҢҖн•ң м§ҖмҶҚм Ғмқё кҙҖм°°кіј 추세лҘј нҢҢм•…н•ҳлҠ” кІғмқҖ н•ҷл¬ём ҒмңјлЎңлӮҳ мӢӨл¬ҙм ҒмңјлЎң л§Өмҡ° мӨ‘мҡ”н•ң мқјмқҙлӢӨ. мң к°Җк°Җ лІҢнҒ¬м„ мҡҙмһ„м—җ м—¬м „нһҲ мғҒлӢ№н•ң мҳҒн–Ҙмқ„ лҜём№ҳкі мһҲлҠ” кІғмқҖ м—¬лҹ¬ к°Җм§Җ н•Ёмқҳ к°–лҠ”лӢӨкі ліёлӢӨ.

к·ёлҹјм—җлҸ„ л¶Ҳкө¬н•ҳкі ліё м—°кө¬лҠ” мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ мғҒкҙҖкҙҖкі„лҘј м¶”м •н•ҳлҠ”лҚ° мһҲм–ҙм„ң лӢӨмқҢкіј к°ҷмқҖ м—°кө¬мқҳ н•ңкі„лҘј лӮЁкёҙлӢӨ. мІ«м§ёлҠ” лІҢнҒ¬м„ мҡҙмһ„мқҳ ліҖлҸҷм„ұ нҢҢкёүнҡЁкіјлҘј л°ҳмҳҒн•ҳм§Җ лӘ»н–ҲлӢӨ. мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„кіј кҙҖл Ёлҗң лҚ°мқҙн„°лҘј мҲҳ집함м—җ мһҲм–ҙм„ң мӣ”к°„ лҚ°мқҙн„°лҘј мқҙмҡ©н•ҳмҳҖкё° л•Ңл¬ём—җ мқјк°„ лҚ°мқҙн„°лҘј мқҙмҡ©н•ң мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ ліҖлҸҷм„ұ нҢҢкёүнҡЁкіјлҘј м¶”м •н•ҳм§Җ лӘ»н–ҲлӢӨ. л‘ҳм§ёлҠ” лІҢнҒ¬м„ мҡҙмһ„мқҳ м„ л¬јмӢңмһҘ нҠ№м„ұмқ„ л°ҳмҳҒн•ҳм§Җ лӘ»н–ҲлӢӨ. 2008л…„ 10мӣ”л¶Җн„° 2020л…„ 2мӣ”к№Ңм§Җ BDI, BCI, BPI мҡҙмһ„м§ҖмҲҳм—җ лҢҖн•ң лҚ°мқҙн„°лҠ” нҳ„л¬јмӢңмһҘмқҳ мһҗлЈҢлҘј мқҙмҡ©н•ҳмҳҖкё° л•Ңл¬ём—җ BCIмҷҖ BPI мҡҙмһ„м§ҖмҲҳ мӢңмһҘмқҳ м„ л¬јк°ҖкІ©мқ„ м—°кө¬лӘЁнҳ•м—җ л°ҳмҳҒн•ҳм§Җ лӘ»н–ҲлӢӨ. м…Ӣм§ёлҠ” мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ л№„м„ нҳ• кҙҖкі„лҘј л°ҳмҳҒн•ҳм§Җ лӘ»н–ҲлӢӨ. мөңк·јмқҳ м—°кө¬м—җм„ң мң к°Җ ліҖлҸҷм„ұкіј көӯм ңкёҲмңө л°Ҹ л¬ҙм—ӯнҷҳкІҪмқҳ ліҖнҷ”м—җ л”°лқј мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ мғҒкҙҖкҙҖкі„м—җ лҢҖн•ң м—°кө¬лҠ” кё°мЎҙмқҳ м„ нҳ•кҙҖкі„лҘј м¶”м •н•ң м—°кө¬л“Өмқ„ м Ғмҡ©н•ҳлҠ”лҚ° н•ңкі„к°Җ мһҲмқҢмқ„ м ңмӢңн•ҳкі мһҲлӢӨ. ліё м—°кө¬лҠ” мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ мғҒкҙҖкҙҖкі„лҘј м¶”м •н•Ём—җ мһҲм–ҙ м ңн•ңм Ғмқё л…јмқҳлҘј н•ҳкі мһҲмңјл©°, лІҢнҒ¬м„ мҡҙмһ„мқҳ ліҖлҸҷм„ұ нҢҢкёүнҡЁкіј, лІҢнҒ¬м„ мҡҙмһ„мқҳ м„ л¬јмӢңмһҘ нҠ№м„ұ, мң к°ҖмҷҖ лІҢнҒ¬м„ мҡҙмһ„ к°„мқҳ л№„м„ нҳ• кҙҖкі„ мёЎл©ҙм—җм„ң м—°кө¬мқҳ н•ңкі„лҘј лӮЁкё°л©°, н–Ҙнӣ„мқҳ м—°кө¬м—җм„ң мқҙ м җмқҙ л°ҳмҳҒлҗҳм–ҙм•ј н•ҳкІ лӢӨ.

TableВ 1.

Descriptive statistics

| Mean | S.D | Min | Max | Skew | Kurt | J-B | N | |

|---|---|---|---|---|---|---|---|---|

| LBDI | 1.49 | 0.88 | 0.31 | 4.82 | 1.38 | 4.61 | 68.02*** | 161 |

| LBCI | 2.25 | 1.38 | вҲ’0.24 | 7.80 | 1.22 | 5.27 | 74.45*** | 161 |

| LBPI | 1.53 | 0.90 | 0.32 | 4.30 | 1.25 | 3.95 | 48.18*** | 161 |

| LDUBAI | 72.61 | 24.65 | 20.39 | 122.49 | 0.22 | 1.92 | 9.15** | 161 |

| LBRENT | 74.99 | 25.18 | 26.63 | 124.54 | 0.30 | 1.89 | 10.64*** | 161 |

| LWTI | 68.80 | 21.68 | 16.70 | 110.04 | 0.11 | 1.92 | 8.18** | 161 |

TableВ 2.

ADF unit root test

| кө¬ 분 | Difference | |||||

|---|---|---|---|---|---|---|

| LBDI | LBCI | LBPI | LDUBAI | LBRENT | LWTI | |

| ADF | вҲ’7.322 | вҲ’7.920 | вҲ’7.744 | вҲ’8.078 | вҲ’7.886 | вҲ’8.355 |

| p | 0.00*** | 0.00*** | 0.00*** | 0.00*** | 0.00*** | 0.00*** |

TableВ 3.

Granger causality test

| Null hypothesis | F-statistic | Probability |

|---|---|---|

|

|

||

| LDUBAI вҮҸ LBDI | 7.934 | 0.000*** |

| LBDI вҮҸ LDUBAI | 1.510 | 0.224 |

|

|

||

| LBRENT вҮҸ LBDI | 4.279 | 0.015*** |

| LBDI вҮҸ LBRENT | 1.629 | 0.199 |

|

|

||

| LWTI вҮҸ LBDI | 4.988 | 0.007*** |

| LBDI вҮҸ LWTI | 2.389 | 0.095* |

|

|

||

| LDUBAI вҮҸ LBCI | 7.129 | 0.001*** |

| LBCI вҮҸ LDUBAI | 0.289 | 0.749 |

|

|

||

| LBRENT вҮҸ LBCI | 3.672 | 0.027** |

| LBCI вҮҸ LBRENT | 0.272 | 0.761 |

|

|

||

| LWTI вҮҸ LBCI | 6.846 | 0.000*** |

| LBCI вҮҸ LWTI | 0.204 | 0.815 |

|

|

||

| LDUBAI вҮҸ LBPI | 9.439 | 0.000*** |

| LBPI вҮҸ LDUBAI | 1.480 | 0.230 |

|

|

||

| LBRENT вҮҸ LBPI | 7.313 | 0.000*** |

| LBPI вҮҸ LBRENT | 1.360 | 0.259 |

|

|

||

| LWTI вҮҸ LBPI | 4.907 | 0.000*** |

| LBPI вҮҸ LWTI | 1.676 | 0.190 |

References

[1] Akyol, K(2019), вҖңвҖңForecasting of Dry Freight Index Data by Using Machine Learning AlgorithmsвҖқвҖқ, I.J Intelligent Systems and Applications, Vol. 8, pp. 35-43.

[2] Aloui, R, Gupta, R and Miller, S. M(2016), вҖңвҖңUncertainty and Crude Oil ReturnsвҖқвҖқ, Energy Economics, Vol. 55, pp. 92-100.

[3] Apergis, N and Payne, JE(2013), вҖңвҖңNew Evidence on the Information and Predictive Content of the Baltic Dry IndexвҖқвҖқ, International Journal of Financial Studies, Vol. 1, No. 3, pp. 62-80.

[4] British Petroleun(2021). Statistical Review of World Energy, https://www.bp.com.

[5] Chung, SK and Kim, SK(2011), вҖңвҖңA Study on the Effect of Changes in Oil Price on Dry Bulk Freight Rates and Intercorrelations between Dry Bulk Freight RatesвҖңвҖқ, Journal of Korea Port Economic Association, Vol. 27, No. 2, pp. 217-240.

[6] Cristina, C and Luciani, M(2017). вҖңOil price pass-through into core inflation,вҖқ, Finance and Economics Discussion Series 2017-085 Available at SSRN: https://ssrn.com/abstract=3029735..

[7] Dai, S, Zeng, Y and Chen, F(2016), вҖңвҖңThe Scaling Behavior of Bulk Freight Rate VolatilityвҖқвҖқ, International Journal of Transport Economics, Vol. 43, No. 1-2, pp. 85-104.

[8] Hasan, B, Mahi, M, Saker, T and Amin, R(2021), вҖңвҖңSpillovers of the COVID-19 Pandemic : Impact on Global Economic Activity, the Stock Market, and the Energy SectorвҖқвҖқ, Journal of Risk Management, Vol. 14, No. 5, pp. 1-18.

[9] Jeon, KJ and Yang, CH(2016), вҖңвҖңThe Study on Correlation between the Shipbuilding Order Quantity of Major Shipping Liners and Maritime Freight Rates : Using Granger Causality AnalysisвҖқвҖқ, The Korea Association of Shipping and Logistics, Vol. 32, No. 1, pp. 5-27.

[10] Kim, MH, Lee, KH and Kim, JY(2014), вҖңвҖңCausality Test of the Relationship between the Freight Indexes and the Ship Prices in Second-hand Bulk MarketвҖқвҖқ, The Korea Association of Shipping and Logistics, Vol. 3, No. 3, pp. 637-654.

[11] Kim, HS and Chang, MH(2013), вҖңвҖңAnalysis of Asymmetric Long-run Equilibrium between Bunker Price and BDI(Baltic Dry-bulk Index)вҖңвҖқ, Journal of Korea Port Economic Association, Vol. 29, No. 2, pp. 63-79.

[12] Kim, DH, Kim, HM, Sim, SH, Choi, YL, Bae, HL and Yun, HS(2019), вҖңвҖңPrediction of Dry Bulk Freight Index Using Deep LearningвҖқвҖқ, Journal of Korean Institute of Industrial Engineers, Vol. 45, No. 2, pp. 111-116.

[13] Kim, DI(2011), вҖңEconometric Analysis with EViews, Philosophy & ArtвҖқ.

[14] Korea Energy Economics Institute(2022), вҖң100 days of the Russian-Ukraine war : The impact of the prolonged global energy supply crisis on the domestic economy and energy sector and response strategiesвҖқ.

[15] Lim, SS and Yun, HS(2018), вҖңвҖңAn analysis on Determinants of the Capesize Freight rate and Forecasting ModelвҖқвҖқ, J. Navig Port Res, Vol. 42, No. 6, pp. 539-545.

[16] Munim, ZH and Schramm, HJ(2021), вҖңвҖңForecasting Container Freight Rates for Major Trade Routes : A Comparison of Artificial Neural Networks and Conventional ModelsвҖқвҖқ, Maritime Economics & Logistics, Vol. 23, No. 2, pp. 310-327.

[17] Rim, JK, Kim, WH and Ko, BW(2010), вҖңвҖңAn Empirical Analysis of the Dry Bulk Market Using a Recursive VAR ModelвҖқвҖқ, The Korea Association of Shipping and Logistics, Vol. 26, No. 1, pp. 5-27.

- TOOLS

PDF Links

PDF Links PubReader

PubReader ePub Link

ePub Link Full text via DOI

Full text via DOI Download Citation

Download Citation Print

Print