Optimal Dual Pricing and Passenger Safety Level for Cruise Revenue Management

Article information

Abstract

Despite the remarkable continual growth of the world cruise industry, studies have yet to be attempted on many revenue management problems in cruise operations. This paper suggests two schemes that can be easily applied to cruise revenue management: optimal dual pricing and passenger safety level. In optimal dual pricing, a pair of higher and lower prices is applied to cabin reservation through market segmentation. This scheme can be executed with a linear price-response function for the current unreserved cabins. A cruise line could benefit from this scheme to maximize reservation revenue while attaining full occupancy. The dual pricing scheme is also devised to produce only integer demands to suit real management practices. The life boat capacity is an additional service capacity unique to the cruise industry, catering to passengers’ safety. The concept of passenger safety level is defined and computed for any passenger life boat capacity of a cruise ship. It can be used to evaluate the passenger safety of a cruise ship in operation, as well as to determine the number of life boat seats required for a new cruise ship. Hypothetical examples are used to illustrate the operation of these two schemes.

1. Introduction

Although the world cruise industry has shown a remarkable average annual growth of 6.55% during the last three decades(Cruise Market Watch, 2017), relatively limited academic researches have been attempted to improve the management decisions of cruise operation. A comprehensive survey of existing researches and future issues including cruise revenue management are found in Sun et al.(2011).

The purpose of this paper is to develop two easily implementable schemes for cruise revenue management: optimal dual pricing and passenger safety level. There have been many practices of revenue management in various industries including price differentiation, demand control, capacity adjustment, and overbooking. A review of revenue management applications in many industries is found in Chiang et al.(2007). A significant concern in the revenue management for cruise operation differentiated from other industries is in the life boat capacity, which should be considered important for passenger safety. Recently a dynamic programming model for cruise reservation management was developed(Maddah et al., 2010), which considers the life boat capacity as a constraint and rejects any new reservation request if the accumulated reservation has reached the passenger life boat capacity. The revenue management in cruise industry also has more issues to consider than that in other industries such as on-board spending, longer booking period, and very low no-show rate(Biehn, 2006; Talluri and van Rhyin, 2005). A network optimization model recently has been developed for the cruise itinerary planning(Cho et al., 2012), which is one of the major strategic decisions for cruise revenue management. Some early ideas of price differentiation for cruise reservation management are found in Ladany and Arbel(1991), and various issues of pricing in cruise industry are discussed in Lieberman(2012).

The optimal dual pricing developed in this paper supposes an effective market segmentation of the cruise market into two and a linear price-response function(Phillips, 2012) for the unreserved cabins. It is developed to be implemented on a real time basis with a reliable estimation of the linear price-response function, and produces integer values of cabin demands fit for practical management applications. The beneficial goal of the optimal dual pricing is to maximize the revenue from cruise reservations while selling all the cabins. Easy computations are also developed for a cruise line to develop its own optimal dual pricing policies by simply maximizing a quadratic revenue function. A practical formula to produce dual pricing policies is derived, and the associated decision making implications for cruise reservations are provided.

A significant benefit from applying the optimal dual pricing is the attainment of full occupancy to eliminate the problem of perishable service capacity(Fitzsimmons et al., 2014), which implies that any vacant cabin is a lost opportunity of a cruise sale. The total number of passengers in real cruises are often found to be greater than the total number of life boat seats reserved for passengers, especially more often at full occupancy. In this light, the concept of passenger safety level of a cruise ship is defined associated with the life boat capacity. An easy computation of the passenger safety level is established using the well-known normal probability approximation. Managerial implications of the passenger safety level are also suggested both for a cruise ship in operation and the design of a new cruise ship.

A hypothetical cruise operation is used to show easy developments of the optimal dual pricing policy for cruise reservation revenue management. Some computations of the passenger safety level are also provided for the numerical examples.

2. Optimal dual pricing

The purpose of the dual pricing policy developed in this paper is to provide an easily implementable tactic for the revenue management in cruise reservation. It aims to maximize the cabin reservation revenue while maintaining the full occupancy for cruises.

It is assumed that a cruise line has a reliable estimation of the linear price-response function(Phillips, 2005) for the current unreserved cabins. The reservation for a cruise is under way and the number of unreserved cabins currently is n. There are usually multiple cabin classes in a cruise ship, but this paper assumes a single cabin class. It should be noted, however, that the results obtained in this paper are also applicable to multiple classes, if the demands for different class cabins are independent of each other. The price-response function, D(P), for the unreserved cabins appears as in (1).

It is clear to see that all of the n cabins will be sold if the cruise price is as low as P0. This also implies that the price-response function is, in fact, defined only for P ≥ P0. The price elasticity of demand is completely determined by e(>0), and increases as e increases. Usually in practical cruise operations the variable cost per cabin is negligible, and the total operating cost is virtually the sum of very high fixed costs regardless of the occupancy level(Ladany and Arbel, 1991). This implies that the cruise line has only to maximize the total revenue for the optimal reservation management.

Suppose there is only one single price applied to the entire reservation. Then the optimal single price can be found by maximizing the following revenue for P ≥ P0.

Since Rs(P) also is expressed to involve a perfect square term as follows in (2),

Rs(P) is maximized at

For any value of D, let ⌊D⌋ be the biggest integer no greater than D, and ⌈D⌉ the smallest integer no less than D. For an example, it is clear that⌊1.5⌋ = 1 and ⌈1.5⌉ = 2. Then the following theorem gives the optimal single pricing policy for the revenue management to maximize Rs(P) with the corresponding integer demand value for cabin.

Theorem 1. The revenue Rs(P) is maximized at P = Ps while maintaining D(Ps) to have an integer value.

1) If n < eP0, then Ps = P0.

2) If n ≥ eP0, then Ps = P* + Δ where

(Proof) 1) If n < eP0 holds, then

If n ≥ eP0, then P* ≥ P0. If

If n is small enough and n < eP0, Theorem 1 shows that the single pricing at P0 maximizes the revenue, and leaves no vacant cabin since n(P0) = n from (1). On the other hand, if n ≥ eP0, Theorem 1 also implies that the single pricing is vulnerable to the problem of perishable service capacities, i.e. unsold cabins. Suppose n > eP0 and f ≤ 0.5, then the following (5) shows that the number of empty cabins at Ps, n–D(Ps), is positive, which is clearly a lost revenue opportunity. It should be noted that the only single price guaranteeing the full occupancy is P0.

The dual pricing in this paper is to overcome the problem of this perishable service capacity in (5) as well as to increase revenue by segmenting the market into two. There are many practical tactics for segmenting a cruise market for price differentiation based on such factors as time, region, age, preference, discount coupons, etc. A common example of market segments into two for pricing can be found when a cruise line promotes an early on-line booking for a lower discount price before applying a higher price for late reservations.

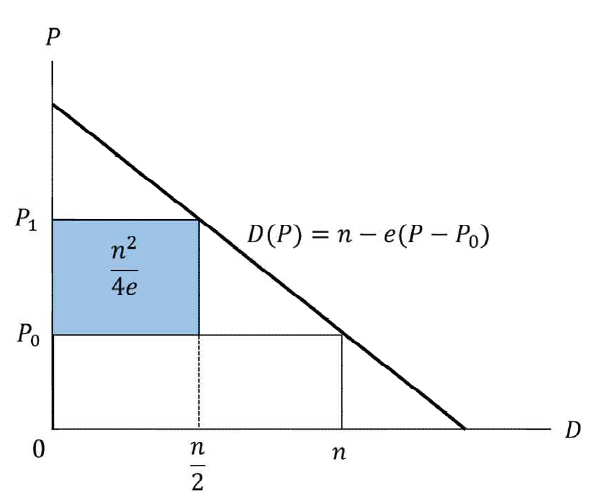

The optimal dual pricing suggests applying a pair of two different prices, one to each of the two market segments. It is assumed for simplicity that there is no shift of demand between the two market segments. Cruise reservations are made, in part, at a lower price for one market segment, and at a higher price for the rest(the other market segment). The lower price is set to P0 to ensure the full occupancy, and the higher price is chosen to maximize the total reservation revenue from both market segments. If P is a higher price, the revenue function for the dual pricing is as follows, and the cruise line would try to maximize it.

From (1), Rd(P) appears a quadratic function of P as follows in (6),

and Rd(P) is maximized at

Theorem 2. The revenue Rd(P) is maximized at P = P1 while maintaining the integer property of the corresponding demand D(P1).

(Proof.) If n is even,

Again from (6), the additional revenue of the optimal dual pricing over the single pricing at P0 is

The dual pricing, with a pair of the lower P0 and the higher P1, is to be implemented on the condition that the market can be segmented into two. Any measures taken by the cruise line to segment the market incur a certain amount of segmenting cost. If the market segmentation works well with little demand shift between the market segments, then the cruise line can expect an additional revenue from applying this dual pricing. Let cs be the cost for the market segmentation. Then Theorem 2 also leads to the following decision criteria to implement the dual pricing for cruise revenue management.

If the number of unreserved cabins (n) is even and

If the number of unreserved cabins (n) is odd and

In practice, price differentiations for revenue management are usually implemented on a real time basis to make the best use of the latest market information and the remaining service capacity. Whenever a reliable estimation of the linear price-response function is available, the suggested optimal dual pricing could be an easy practical tactic aiming for both revenue increase and full occupancy, based on an effective market segmentation.

3. Passenger safety level

The life boat capacity, which is the total number of life boat seats installed in a cruise ship is another significant service capacity unique in the cruise revenue management. It is substantially important for passenger safety in times of emergency. Maddah et al. (2010) developed a dynamic programming cruise reservation model, where the life boat capacity is included as a constraint and any marginal booking request is rejected if the accumulated reservation attains the life boat capacity. Different from the cruise cabin capacity, the life boat capacity is not for revenue but for passenger safety. Usually a cruise ship has a good number of life boat seats enough to accommodate more than the double occupancies for all cabins(P&O Cruises, 2017). Successful applications of the dual pricing developed in this paper would fill all the cabins, many of which could have more than double occupancy. This implies the real number of passengers is often greater than the number of life boat seats reserved for passengers, and the passengers might encounter life threatening disaster in cases of unexpected emergency. It should be added that the safety of cruise operation, in fact, involves various managerial and legal issues besides the life boat capacity. A comprehensive introduction of safety issues of cruise operation such as vessel sanitation, passenger security, and the relevant risk management practices can be found in Gibson(2012).

Suppose a cruise ship has n cabins, and let Xi be the number of passengers in cabin i which is a random variable. Since all n cabins are in the same class and so equipped with the same facilities and layouts, it is assumed that n random variables Xi, i = 1,…,n, have an identical probability distribution. The total number of passengers on board at departure date, X, is as follows.

It is also assumed that the numbers of passengers in different cabins are independent of each other, i.e. X1,…,Xn are mutually independent random variables. Let μ be the mean of Xi (i = 1,…,n), and σ2 the variance of Xi. Then the mean, μX, and the variance, σ2X, of X are computed as follows respectively.

Let m be the passenger life boat capacity of a cruise ship, which is the total number of life boats installed and reserved for passengers in the cruise ship. If X ≤ m, a life boat seat is always available for each passenger in any unexpected emergencies. If X > m, then there would be a positive number of passengers with no life boat seats. In this sense the passenger safety level of a cruise ship is suggested and defined as follows.

Definition 1. Suppose a cruise ship has the passenger life boat capacity of m. Then the passenger safety level, Lm, of the cruise ship is defined as the following probability.

From (9), the passenger safety level of a cruise ship is the probability that every passenger on board could find their own life boat seats in times of emergency. It is clear that Lm increases as m increases, and higher values of Lm would provide safer cruises.

For any cruise ship in operation, an approximate value of the passenger safety level can be computed easily using the well-known Central Limit Theorem(Hogg and Craig, 1978). Since X1,…,Xn are assumed to be identically and independently distributed, the Central Limit Theorem implies that

Then the passenger safety level of a currently operating cruise ship with the passenger life boat capacity of m is approximately computed using the standard normal probability distribution, as follows.

Suppose the cruise line considers investing in a new cruise ship with the service capacity of n cabins, and has a reliable estimation of the probability distribution of the number of passengers Xi from the past experiences. If there is any aspired goal, a, for the passenger safety level, then the minimum number of total life boat seats ma to install for passengers in the cruise ship can also be found by solving the following probability equation.

The relation (10) can compute and evaluate the passenger safety level for any cruise ship in operation, while (11) could be used to determine the number of life boat seats for passengers in a new cruise ship when it is designed.

4. Numerical examples

This section develops the optimal dual pricing policies for a hypothetical cruise operation, and computes the passenger safety levels using simple imaginary data.

4.1. Computations of optimal dual pricing

Suppose a cruise line is in the process of booking for a specific cruise, and the current number of unreserved cabins is 100(n = 100). All the cabins have the same size and identical facilities, and a reliable price-response function of (1) is estimated for the 100 cabins with e = 50, and P0 = 1. This implies that all the 100 cabins will be sold at the reservation price of 1(=$1,000), and the price response function is as follows.

Since 100 ≥ 50 · 1, the optimal single price Ps to maximize the reservation revenue is computed as follows by Theorem 1.

Since D(Ps)=D(1.5)=75, 75 cabins will be booked, but the rest 25 cabins will be left unreserved. This shows the problem of perishable capacity of 25 empty cabins resulting from this single pricing. The only single price for full occupancy is P0 = 1. The dual pricing developed in this paper fills all the cabins while yielding more revenue than the full occupancy single pricing at P0 = 1. Since n = 100 is an even number, the optimal higher price P1 is computed to be as follows by (7) in Theorem 2.

Since D(P1)=D(2)=50, the cruise line can get additional revenue of

For an odd number instance, suppose n = 95. Then the corresponding price-response function appears as follows.

Again, from Theorem 1, the optimal single pricing is computed as follows.

Since D(Ps) = D(1.46)=72 and n-D(Ps)=23, again 23 cabins will remain empty, which corresponds to a lost revenue opportunity. The optimal dual pricing by Theorem 2 computes the higher price P1 as follows.

D(P1) = D(1.96)=47 suggests that 47 cabins should be booked at P1 = 1.96, and the rest(48 cabins) at P0 = 1. By this dual pricing based on an effective market segmentation would give more revenue of

4.2. Computations of passenger safety level

Suppose a cruise line has a cruise ship, currently in operation, with the total number of 100 cabins(n = 100) of the same class. Let Xi be the number of passengers in cabin i(i = 1,…,100), which is a random variable. A typical booking for a cabin usually is of double occupancy(two passengers). However, many cabins are frequently found to accomodate 3, 4, or even 5 passengers(Lieberman, 2012). After a successful introduction of the optimal dual pricing for revenue management, the cruise line has eliminated the problem of perishable cabin capacity, and estimated the probability distribution of Xi from the accumulated records of cabin reservations as in Table 1.

Since μ = 2.4 and σ2 = 0.64 from the distribution of Table 1, the mean μX and the variance σ2X of the total number of passengers X in (8) are computed as follows.

Since cruise ships in general have more life boat seats than the double occupancies in all cabins, it is not needed to compute the passenger safety level for m ≤ 200. Suppose m = 240, then (10) computes L240 = P(Z≤0) = 0.5 using the normal probability approximation. This implies that about half of the cruises would leave a positive number of passengers with no opportunity to find their own life boat seats. Even though 240 is greater than the number of passengers at the full double occupancy(2 × 100 = 200), it is clear that the cruise ship needs much more life boat seats to be ready for any potential emergencies. Again from (10), it is computed that L240 = 0.894, L255 = 0.970, and L260 = 0.994. Especially, L260 = 0.994 implies that almost all(99.4%) cruises would be safe with the passenger life boat capacity of 260 for all the passengers could find their own life boat seats in time of emergency.

Suppose a cruise line considers investing in a new cruise ship of 100 cabins of the same class and wants to attain the passenger safety level of 95%(a = 0.95). From solving the probability equation in (11), it is found that a = 253.2. This suggests that the new ship should be equipped with more than 253 life boat seats for passengers. This should be reflected in designing the new cruise ship. If a = 0.99 is a safety goal, then (11) computes a greater passenger life boat capacity of m = 285.6, and implies the new ship requires at least 259 life boat seats for passengers.

5. Conclusions

This paper has developed the concepts of optimal dual pricing and passenger safety level, both of which imply easy revenue management schemes implementable for cruise operation.

The two beneficial goals of the optimal dual pricing are to achieve the maximum reservation revenue and to maintain the full occupancy. The dual pricing policy works by applying a pair of reservation prices to two different segments of market, a lower price P0 to one market segment and a higher price P1 to the other. This dual pricing works on an effective effort to segment the market into two by the cruise line. It eliminates the inevitable problem of perishable cabin capacity of the single pricing while maximizing the additional revenue over the single pricing at P0. The dual pricing can be implemented anytime during the cruise booking period when a dependable estimation of the linear price-response function for unreserved cabins is available. It is easily implementable in the sense that a cruise line can develop its own dual pricing policies by simply maximizing a quadratic revenue function. A practical formula to produce the optimal dual pricing for any given number of the current unreserved cabins, and the following decision making criteria are also developed. Especially, the dual pricing in this paper has been devised to produce only integer values of cabin demands to fit in with usual management practices. If the cost of market segmentation is expected less than the additional revenue from the dual pricing, the cruise line could benefit from applying it.

The passenger safety level, suggested in this paper, is the probability that each passenger on board can access their own life boat seats in times of emergency. It has been defined for any life boat capacity of a cruise ship, and computed using the popular normal probability distribution. It can be used to evaluate the passenger safety of a cruise ship currently in operation, and also to determine the number of life boat seats to install in a new cruise ship for a safety design.

The optimal dual pricing in this paper assumes a single class of passenger cabins. However, it should be noted that it is also applicable to cruise ships with multiple cabin classes if the demands for different class cabins are independent of each other. The optimal dual pricing in this paper works on an effective cruise market segmentation into two. This implies that the dual pricing assumes that there is no shift of demand between the two segmented markets. A possible new research subject would be to develop an extended and more flexible dual pricing model which allows the shifts of demand between the market segments. Real world applications of the optimal dual pricing and the passenger safety level to the cruise operations in practice, and assessing the achieved benefits of these applications are also among future research possibilities.