|

|

| J Navig Port Res > Volume 45(5); 2021 > Article |

|

ABSTRACT

NOTES

2) Ryu, Ki-Jin¡Nam, Hyung-Sik¡Jo, Sang-Ho¡Ryoo, Dong-Keun(2018), âA study on Analysis of Container Liner Service Routes Pattern Using Social Network Analysis: Focused on Busan Portâ, Journal of Korean Navigation and Port Research, Vol. 42, No. 6, pp. 529âź538

4) BPA has been working to integrate Old port into 2(BPT+HBCT) by combining DPCT and BPT. however, project has been frustrated in 2020.

5) DPW has constructed terminal, but, BPA has purchased from DPW, then, gave concession to PSA again

6) Shin, Jae-Young¡Lee, Jang-Gun¡Park, Hyung-Jun,â Simulated Analysis of the Effect of Integrated Operation on Container Terminals in Busan New portâ, Journal of Korean Navigation and Port Research, Vol. 44, No. 6, pp. 477âź487

7) Park, Ho-Chul(2019), âA study on the container Terminal Operator Restructuring in Busan Port for enhancing Global Competitivenessâ, Korean Maritime and Ocean Univ. Ph. D. paper

8) PNIT:3 berths, HJNC: 4 berths, HPNT:4 berths, BNCT: 4 berths, BCT is under construction for 3 berths

9) To operate terminal in the direction to save the operational cost rather than having profit from operation(Profit Center)

10) Drewry Maritime Research(2020), âGlobal Container Terminal Operators Annual Review and Forecastâ

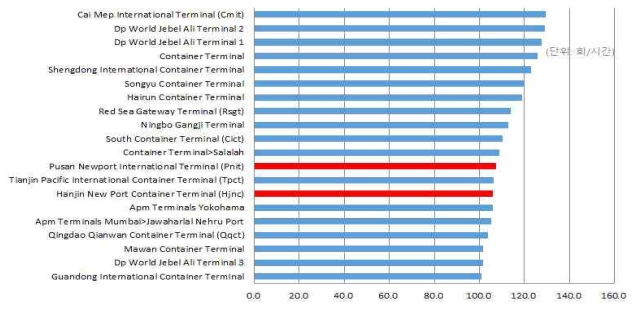

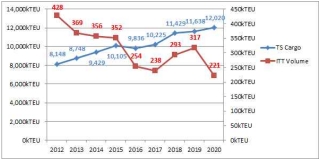

Fig. 1.

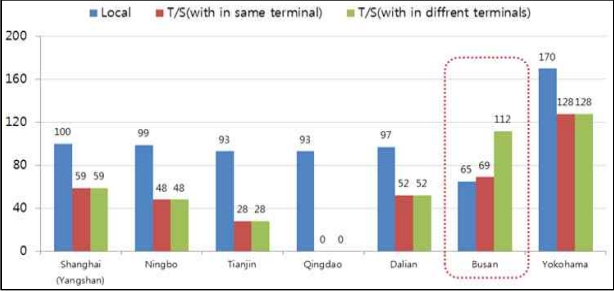

Fig. 2.

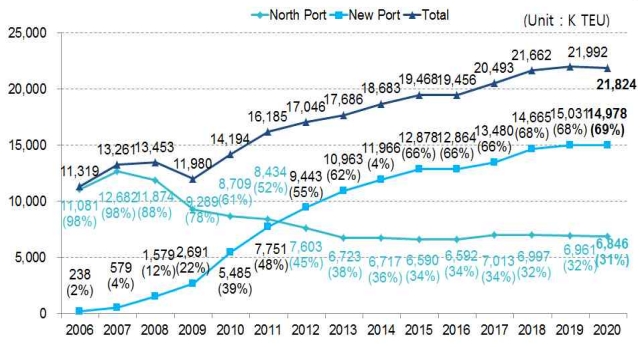

Fig. 4.

Table 1.

Table 2.

| Year | Total | China | Japan | SE Asia | US W/C | US E/C | N. Eu | Med | ME | SA | ETC |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 268 | 46 | 73 | 50 | 28 | 13 | 5 | 11 | 6 | 12 | 24 |

| 2018 | 263 | 42 | 67 | 58 | 30 | 13 | 5 | 11 | 5 | 10 | 22 |

| 2017 | 253 | 35 | 73 | 53 | 29 | 12 | 5 | 8 | 5 | 10 | 23 |

Table 3.

Table 4.

Table 6.

Table 7.

Table 8.

| Tanjung Pagar | Keppel | Brani | Pasir Panjang | |

|---|---|---|---|---|

| Operator | PSA | PSA | PSA | PSA |

| Share(%) | PSA:100 | PSA:100 | PSA:100 | PSA:100 |

| Berth | 7 | 14 | 8 | 7 |

| Type of operator | GTO (PA) | GTO (PA) | GTO (PA) | GTO (PA) |

Table 9.

Table 10.

| Terminal 1 | Terminal 2 | Terminal 3 | Terminal 4 | |

|---|---|---|---|---|

| Operator | DP world | DP World | DP World | DP World |

| Share(%) | 100 | 100 | 100 | 100 |

| Berth | 13 | 8 | 5 | 3 |

| Type of Operator | GTO | GTO | GTO | GTO |

Table 11.

| Port of Tanjung Pelepes | ||

|---|---|---|

| Operator | APMT | MMC Corporation Berhad |

| Share(%) | 30 | 70 |

| Berth | 14 | |

| Type of Operator | GTO | RO |

Table 12.

Table 13.

| Nationality | Sample | Portion(%) | Total (%) | |

|---|---|---|---|---|

| Carrier | National | 32 | 19.6 | 41.7 |

| Foreign | 36 | 22.1 | ||

| Terminal Operator | GTO | 24 | 14.7 | 37.4 |

| National | 37 | 22.7 | ||

| BPA | 34 | 20.1 | 20.1 | |

| Total | 163 | 100.0 | ||

PDF Links

PDF Links PubReader

PubReader ePub Link

ePub Link Full text via DOI

Full text via DOI Download Citation

Download Citation Print

Print